How Do Insurance Companies Pay For Hail Damage

Comprehensive insurance has a deductible, which is the amount you pay before your. How an insurance company pays you.

Six Common Hail Claim Questions And Answers For Tucson Arizona Drivers - Orielly Collision Centers

Because your excess is $900, that’s all you’ll need to pay your insurer.

How do insurance companies pay for hail damage. When you file a claim for hail damage, an insurance adjuster will be part of the process. Comprehensive insurance is the only way to cover hail damage. Some policies also cover unattached structures like your garage, tool shed or gazebo.

Car insurance hail damage claims averaged more than $4,300, according to state farm 2020 hail claims data. If your homeowners insurance claim is approved, then the insurance company will pay your claim. Your insurance company will pay for 100% of the auto hail damage minus your deductible if you have comprehensive coverage.

Insurance adjusters are the people that come out to assess hailstorm damage, evaluate your siding and roofing system, examine your hail damage insurance claim, and determine how much you should get paid to repair your home. Meanwhile, your insurer will foot the bill for the remaining $4,100. Rue21, selecting a top ensure will ensure you the highest rate of success when trying to collect money off of your homeowner’s insurance claims.

The money that you can expect to pay for this is the total bill from the mechanic minus the deductible that you pay. If you’re uncomfortable doing an inspection on your roof, call a trusted contractor to do one. Here are the steps to take:

Some insurance companies might send you a check once the repairs have been made, but some will send you the amount of the estimated repair cost minus your deductible. Considering that a hail storm can end. Generally, adding comprehensive coverage costs an extra $100 to $300 per year.

They hear how much does insurance pay for hail damage often. Photograph the hail damage in detail. What you pay will depend, of course, on your particular amount of damage and your deductible.

Wind and hail homeowners policy deductibles for example, say you have a $1,000 home insurance deductible and you need to make a $5,000 claim after a hail storm damages the shingles on your roof. However, they’re hired and paid by the insurance company, too. If your area has received hail large enough to possibly cause damage to your roof, you may want to examine other objects at ground level before calling your insurance company or pulling out your ladder.

One may also ask, do i have to pay a deductible for hail damage to my roof? If you own your car outright and the damage is merely cosmetic, you may decide not to make the repairs. When storm damage reports are high, contractor availability is low.

Mckinney vehicle owners are probably aware of comprehensive coverage , living in one of the yearly hardest hit areas in the nation. State farm insurance travelers insurance; Between 2008 and 2014, us insurers paid roughly $5.37 billion for auto insurance claims, according to hail data.

Some of the best homeowner’s insurance companies for roofing hail damage claims are: How much does insurance pay for auto hail damage? The highest claim frequency was recorded in 2011 with 4.3 claims per 1,000 insured automobiles in the us due to hail damage.

When this happens, insurance companies will process the claims separately; One claim for the vehicles on the car insurance policy, and a second claim for the home under the home policy. The claims adjusters that home insurance companies send are employees of the insurance companies, which is an important.

How to deal with an insurance adjuster for hail damage claims. If we identify roof damage, we’ll execute our first insurance contract, allowing us to work with your insurer. Of course, this is just an example and what you pay depends on the excess you agree on and the amount of damage your car sustains during a hail storm.

If you also have fallen trees that damage your home, tree removal service may be a part of the policy coverage too. If your policy guarantees coverage for hail damage, your insurance company should be paying for the damage. Insurance companies get flooded with calls after storms.

We will then contact your insurer to file the insurance claim. Take photographs of the damage and the hail, using a tape measure or other object to indicate the size of the hail. How much does insurance pay for hail damage on a car?

If you have comprehensive coverage and your car is indeed covered from hail damage, your car insurance carrier will pay for the repairs. The insurance company agrees to cover your damages, and you will receive compensation for those damages. Shingles will show hail damage due to hail less than 1 inch in diameter, and the hail generally must be more than ¾ inch in diameter (dime size).

Contact your insurance company to initiate the claims process; If the storm damage is widespread, “independent inspectors” are brought in to handle the load of claims. If you do not have comprehensive car insurance, your insurance company is essentially guaranteed not to pay for the damages.

Several people experienced hail damage to both their home and their vehicles in the two most recent storms. If you don't have comprehensive insurance. Depending on the type of claim and the extent of damages, an insurance company could pay you in different ways.

The more information you can provide, the more likely you are to receive coverage for your damage. In 2019, over 7.1 million us properties were affected by hail damage. This means if the damage is caused by wind or hail, claims will be subject to a separate, typically.

When it is covered, you can expect to pay a deductible before the provider helps pay for the rest of the damage. Your insurance company will record basic information about the incident, give you a claims number, and then send an adjuster to your address. The insurance company reimburses your roof claim repairs or rebuilding costs when your property is damaged or destroyed by fires, tornadoes, lightning, hail storms, or other natural disasters.

We’ll inspect your entire home for wind, hail and storm damage. Document the damage with photos and share those with your insurance company.

How Insurance Companies Handle Hail Damage Claims

You Need This Coverage When Hail Dents Your Car Forbes Advisor

Does Car Insurance Cover Hail Damage - Ratelab

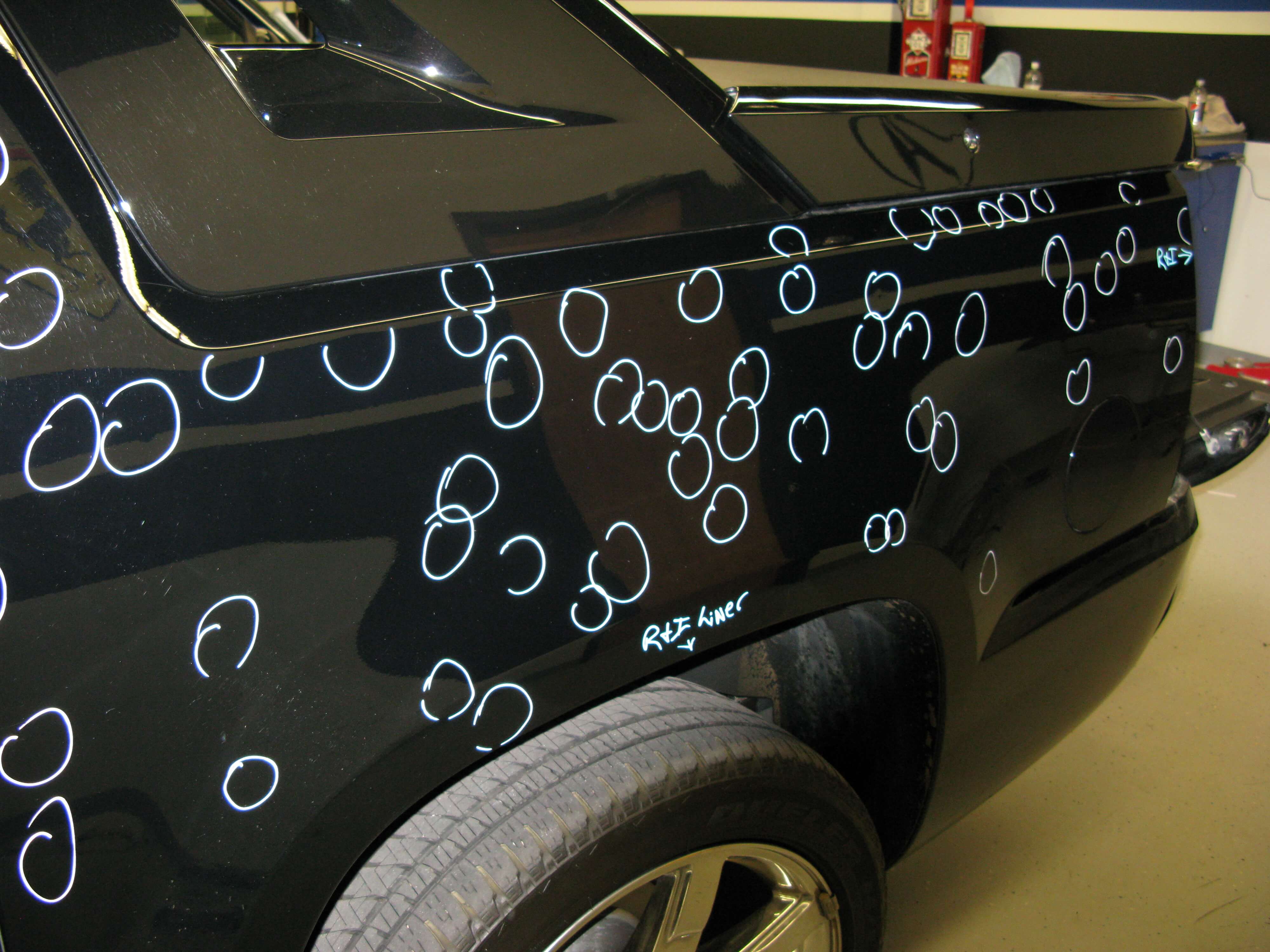

Did Your Insurance Company Lowball Your Hail Repair Estimate - Dent Biz - Paintless Dent Hail Repair

How Do You Know That Its Hail Damage Collision Works Auto Body Paint And Collision Repair

Hail Damage Repair Is Hail Damage To My Windshield Covered By Insurance

Does Car Insurance Cover Hail Damage Nextadvisor With Time

5 Costly Mistakes People Make Dealing With Auto Hail Damage

Does Car Insurance Cover Hail Damage Repairs Hail Free Solutions

Does Car Insurance Cover Hail Damage - Excel Dent Removal Paintless Dent Repair Hail Repair

Why You Should Beware Of Buying A Hail-damaged Car - Car News Carsguide

Hail Damage And Car Insurance Coverage Allstate

Hail Damage What Does Car And Home Insurance Cover Clearsurance

Will Homeowners Insurance Cover Hail Damage To Your Roof

/GettyImages-958790312-5b58c14846e0fb0078c8a428.jpg)

Is Hail Damage To My Car Covered By Insurance

How To File An Insurance Claim For Hail Damage - Emmons

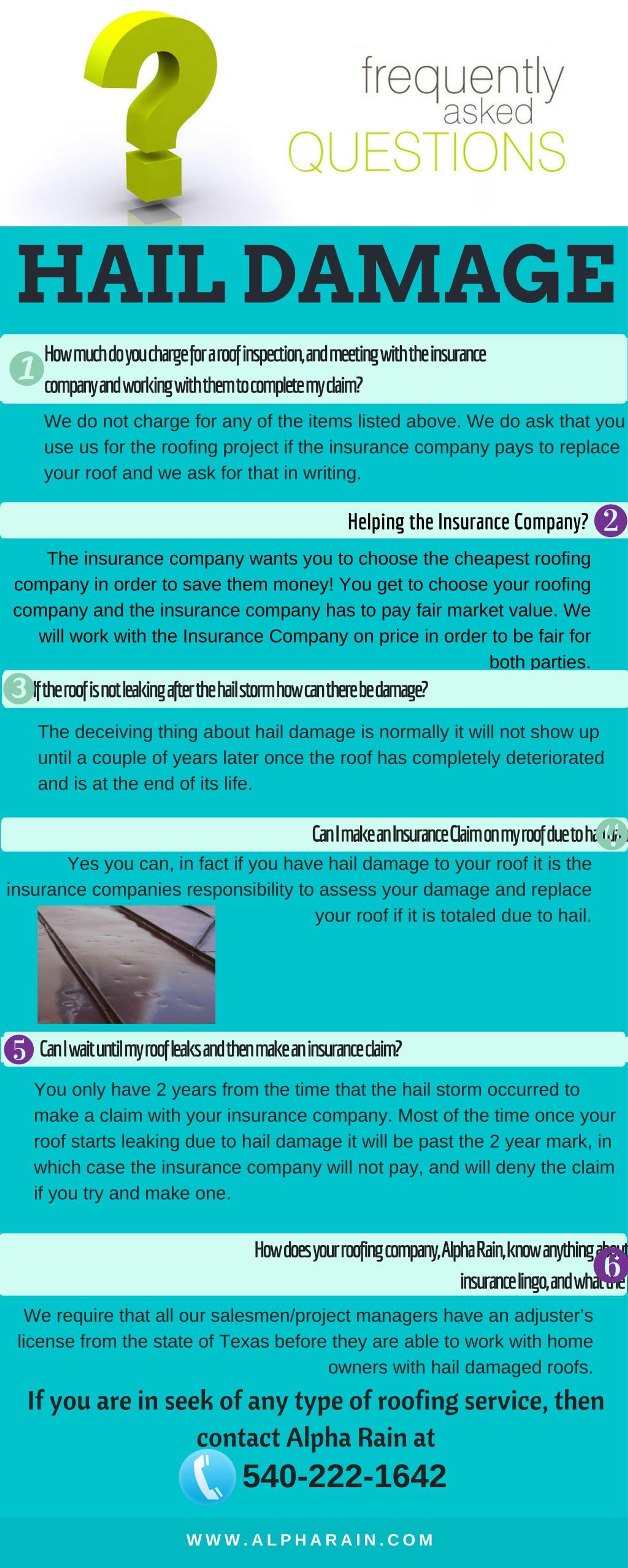

Ppt - Alpha Rain-facts About Hail Damage Powerpoint Presentation Free Download - Id7383451

Car Hail Damage How To File An Insurance Claim - Autocolor

Dallas Hailstorm Insured Losses Could Reach 2 Billion