Ad&d Insurance Meaning

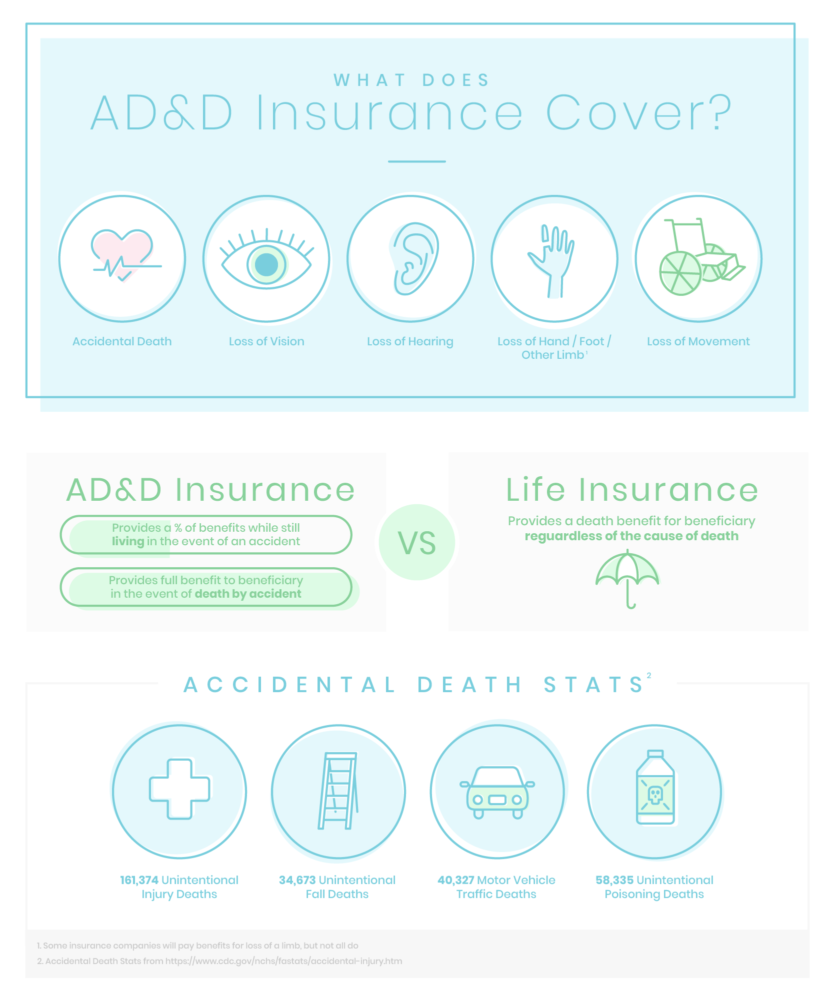

Accidents can happen in an instant, but the consequences can last a lifetime. Life insurance) in the u.s., ad&d is a type of insurance that provides payment if an accident causes death or loss of a limb , eyesight , or hearing.

Business Concept Meaning Accidental Death And Dismemberment Insurance Add With Phrase On The Sheet Stock Photo - Image Of Insurer Costs 182014310

Accidental death and dismemberment insurance, also called ad&d insurance, offers coverage for your family if you lose a limb or pass away due to an accident.

Ad&d insurance meaning. An accidental death and dismemberment (ad&d) insurance policy can help protect your family’s finances in the event of the loss of your life or limb(s). An accidental death in the context of an ad&d insurance policy is a death due to an unforeseen circumstance or event unrelated to your health. The pros and cons of ad&d.

What does voluntary accidental death and dismemberment (ad&d) insurance (vad&d) mean? Basic life with ad&d is most likely a policy that combines both those types of insurance. Accidental death and dismemberment insurance (or ad&d) insurance is a policy that covers only accidents and typically has a much lower payout than a life insurance policy.

Ad&d insurance is not a replacement for life insurance. Accidental death and dismemberment (ad&d) insurance is optional coverage added to a health or life insurance policy that pays out benefits for policyholders who die due to an accident as opposed to natural causes or who lose a bodily limb or eyesight. It can be an affordable way to supplement your life insurance or medical coverage if you’re seriously injured or die as a result of an accident.

That means it doesn't cover death from natural causes like old age or illness. Accidental death and dismemberment insurance normally, ad&d is a rider attached to a life or health policy that gives benefits in case of death by accidental means or provides a set income in case of loss of certain body parts. An ad&d policy pays a benefit for death, loss of use of limbs, loss of speech, loss of hearing, or loss of.

This means that the insured’s death can’t be caused by or related to an illness. Affiliates are separately responsible for their own financial and contractual obligations. Accidental death & dismemberment (ad&d) insurance pays a lump sum benefit to a beneficiary in the event of a covered accident.

Voluntary accidental death and dismemberment (vad&d) insurance policies are policies that pay benefits if the policyholder dies or suffers from dismemberment because of. Ad&d insurance will also pay out some of the benefit in some instances of injury or accidental loss of limbs. Ad&d stands for accidental death and dismemberment insurance.

Lincoln financial group is the marketing name for lincoln national corporation and its affiliates. Ad&d is actually two types of coverage in one policy. Accidental death and dismemberment (ad&d) insurance is an insurance policy that pays a death benefit upon the accidental death of an.

Some employer group plans also allow employees to. It pays the beneficiary if death occurs by accident, or it pays the insured person if they lose a limb. Ad&d insurance is one of the most commonly offered workplace benefits among those surveyed.

Accidents are the fourth leading cause of death in the united states. Deaths attributed to prior medical conditions aren’t covered under an. It only covers accidents, not natural death or injury from illness.

Accidental death and dismemberment (ad&d) insurance. Accidental death and dismemberment (ad&d) insurance is coverage that pays benefits upon the accidental death of an insured or for the accidental loss of a limb. 3 meanings of ad&d abbreviation related to insurance:

Group insurance products and services described herein are issued by lincoln life assurance company of boston. Ad&d insurance is similar to a life insurance policy in that both offer a death benefit, but your beneficiary wouldn't receive a payout if you died due to an illness. What is ad&d meaning in insurance?

Ad&d insurance benefits are payable if you sustain bodily injuries while you are actively employed, through violent, external, and accidental means and as a direct result, you lose your life, limb or eyesight within 90 days of the accident. Accidental death and dismemberment insurance (ad&d) is an insurance policy that offers coverage in case a person dies or becomes disabled. Ad&d riders are usually written so the insurer will pay double the payable amount in case of accidental death.

Application development & delivery (software): Accidental death and dismemberment (ad&d) insurance gives your employees added financial security in sudden and tragic circumstances. An ad&d policy covers death and injury from accidents.

These accidents are defined as unforeseen and are fatal or dismembering. That’s why accidental death and dismemberment insurance, often called ad&d, is worth kn.

What Is Add Insurance - Youtube

The 5 Best Add Insurance Providers Termlife2go

What To Know About Add Insurance Forbes Advisor

/GettyImages-1141164585-f8d2e287983f44c49e4e44012550dad6.jpg)

Voluntary Accidental Death And Dismemberment Insurance Vadd Definition

Video Accidental Death Dismemberment Insurance The Hartford

Essential Guide To Accidental Death Dismemberment Add Insurance

Accidental Death And Dismemberment Insurance What Does Add Insurance Cover Desirepaul Network

Life And Add Insurance

What Is Considered Accidental Death For Insurance Purposes - Glg America

Life And Add The Standard

Understanding What Is Accidental Death And Dismemberment Add Coverage - Youtube

Ad And D Insurance Definition Benefits Coverage Payouts

Life And Add The Standard

/GettyImages-1150533165-1ec0b791840d4c64bfd9f5b76c3c901a.jpg)

Accidental Death And Dismemberment Add Insurance Definition

Accidental Death And Dismemberment Add Insurance

Accidental Death Insurance The 4 Absolute Best Policies

What Is Accidental Death And Dismemberment Insurance

Understand The Differences Between Add And Life Insurance Lgfcu Personal Finance

Accidental Death And Dismemberment Insurance Policy Advice