Key Person Disability Insurance Pays Benefits To The Quizlet

Key person disability insurance pays benefits to the company. Key person disability insurance, also referred to as key man disability insurance or key person replacement coverage, protects a business from economic loss if a key employee, executive, or business owner suffers a disabling accident, injury, or illness.

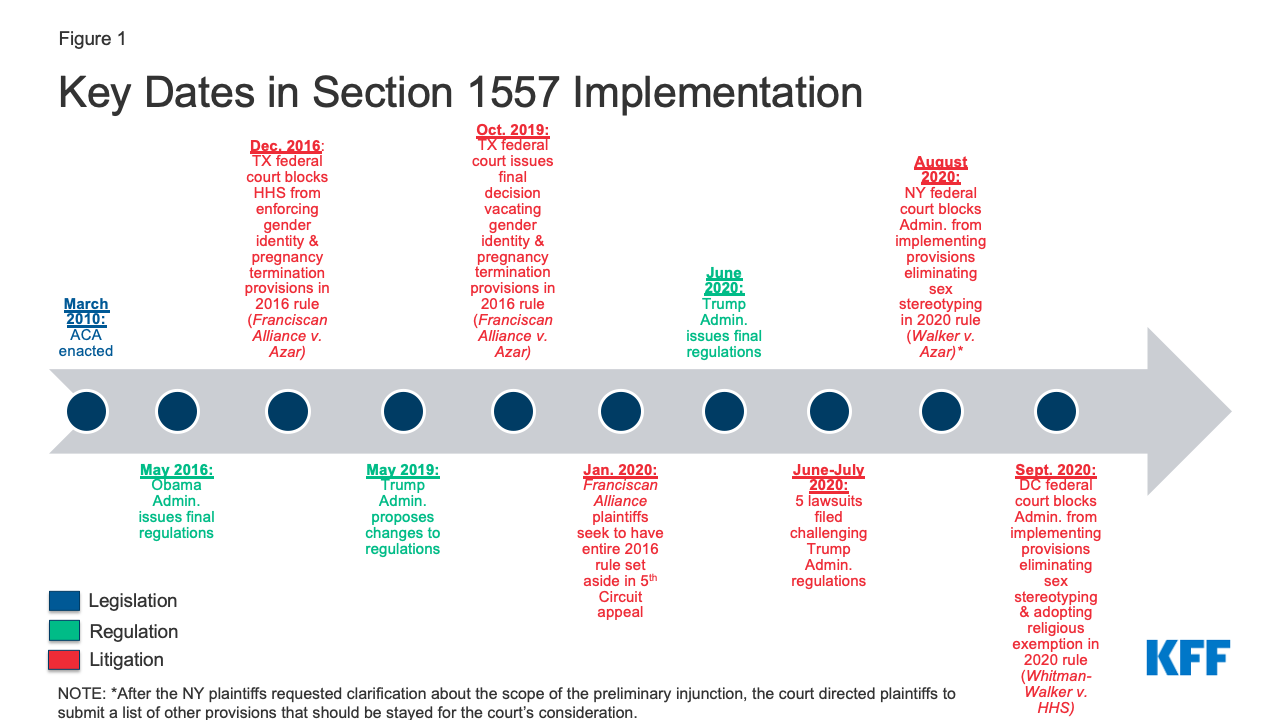

The Trump Administrations Final Rule On Section 1557 Non-discrimination Regulations Under The Aca And Current Status Kff

A key person (key man) disability insurance policy is structured to provide your business with funds to help handle the loss of a key employee should that person become totally disabled.

Key person disability insurance pays benefits to the quizlet. The company is the beneficiary of the plan and. The purpose of the coverage is to allow the business to hire additional help while the employee is disabled. It’s intended to help the company recover from the loss of a key contributor whose death or disability would reduce the company’s value or operational capabilities.

Abc corporation purchases and is beneficiary of an individual disability income insurance policy on a key employee. Which type of disability is less than total impairment? A corporation is the owner and beneficiary of a key person disability policy.

The amount received is tax free. Many businesses provide disability insurance for their workforce, but often, it can be cost prohibitive to offer higher maximum benefits for all employees. Key person insurance pays benefits to a key employee while they are disabled.

It is typically provided through an employer group plan. The purpose of the coverage is to allow the business to hire additional help while the employee is disabled. On the other hand, short term disability income insurance pays out benefits for those who experience temporary injuries and ailments.

Most disability policies pay you a benefit that replaces a percentage of your earned income when you can’t work. Disability insurance pays benefits when you are unable to earn a living because you are sick or injured. What is key person insurance?

Benefits are taxable to the key employee c. Why would an employee purchase disability insurance quizlet? If the corporation collects the policy benefit, then:

Paid for and owned by the business, the policy pays benefits to your business if a key employee becomes totally disabled due to an illness or injury. Key person coverage provides cash flow to help companies move forward and maintain a profit in the event that a key employee becomes disabled. It’s possible to have both types of insurance in place for a key member of a business.

The amount is subject to an exclusionary rule. This type of policy can help your business offset the financial burden of a key contributor being disabled. Total disability in these policies is typically defined as being unable to perform the material duties of his or her occupation and is not working for the business in another role with similar duties and/or.

You can minimize these concerns with key person disability insurance. Key person coverage provides cash flow to help companies move forward and maintain a profit in the event that a key employee becomes disabled. What is key person disability insurance?

What is key person disability insurance? Like all insurance, disability income insurance is designed to protect you against financial disaster. Which of the following statements is true?

Most disability policies pay you a benefit that replaces part of your earned income (usually 50 percent to 70. Key person disability insurance helps your business offset the financial burden of a key contributor being disabled. Key person disability insurance is owned by the business entity.

The business pays the premiums and is the policy’s beneficiary. Key person disability income pays periodic income benefits to businesses when a key employee is disabled. Disability insurance in phoenix, arizona.

Disability income insurance is insurance that pays benefits when you are unable to earn a living because you are sick or injured. In this situation, high limit disability insurance is invaluable. Key person disability income pays periodic income benefits to businesses when a key employee is disabled.

The insurance payment can be used in the same way as key person life insurance. Key person disability insurance provides financial protection for the company if a key person were unable to work due to a disability. Key person disability insurance provides crucial benefits to protect the company financially in the event that a key employee can no longer work due to a disability.

Key person insurance is purchased by a business to insure the life of one of the company’s most vital employees. The most common uses for key person. What is key person disability insurance?

A life insurance policy that a company purchases on a key executive's life. Although you can purchase an individual short term disability insurance policy through some companies, many financial experts advise against it.

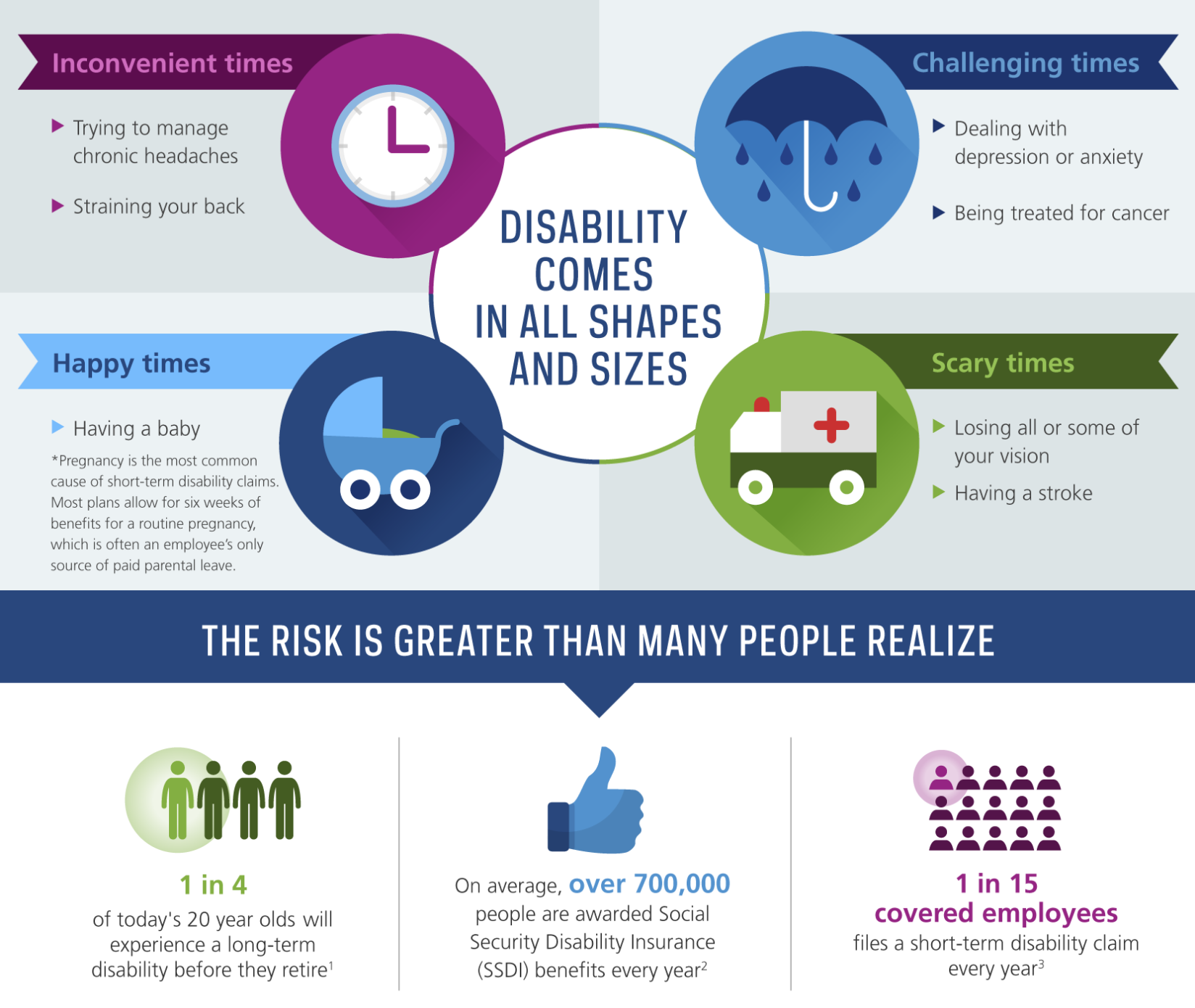

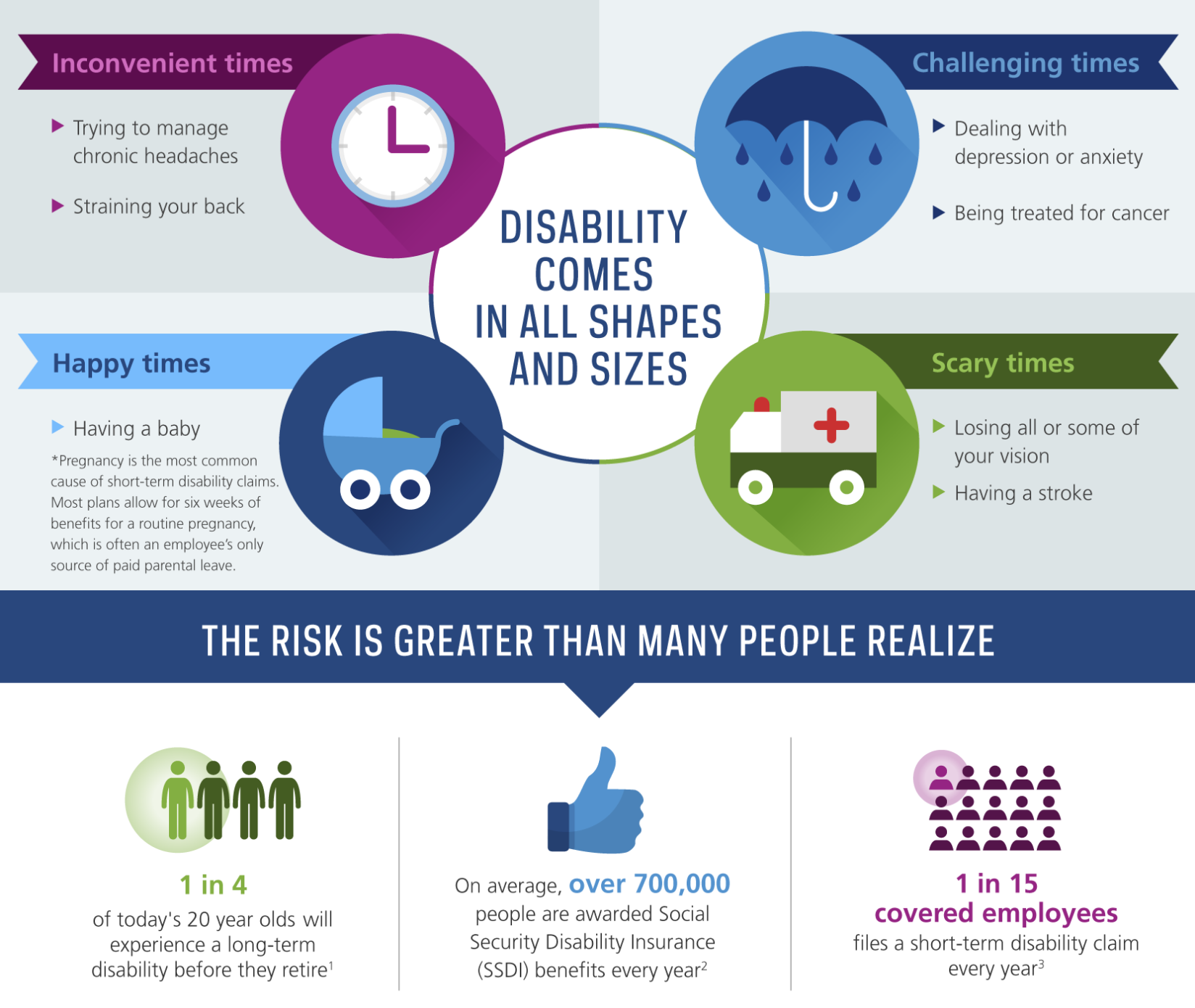

V1 Disability Insurance Infographic_anthem - Anthem The Benefits Guide

How Supplemental Disability Insurance Works For Doctors

/short-term-disability-basics-1177839_V2-5bbd0f8146e0fb0051d0c4cf.png)

Short-term Disability Benefit Basics

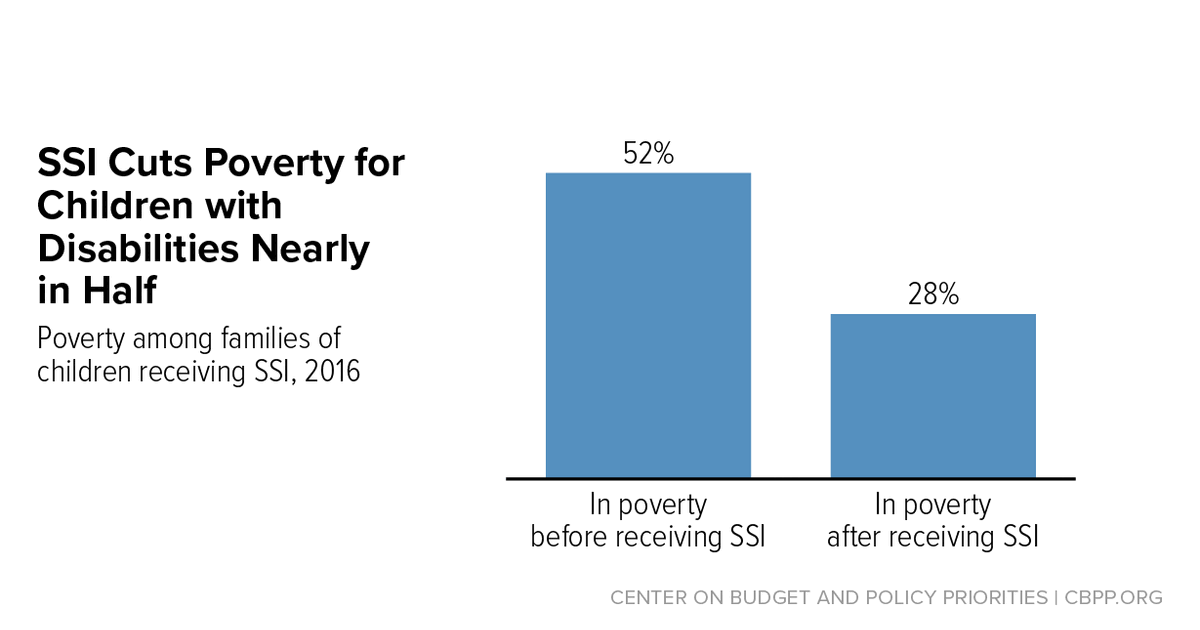

Ssi A Lifeline For Children With Disabilities Center On Budget And Policy Priorities

Disability Insurance And Why You Need It North Carolina Employee Benefits Custom Benefits Solutions

Ch 5 Annuities Flashcards Quizlet

Legal Guide Short Long-term Disability Insurance And Appeals

Chapter 19 - Disability Income Insurance Flashcards Quizlet

Key Person Disability Insurance Guide Key Person Insurance

/short-term-disability-basics-1177839_V2-5bbd0f8146e0fb0051d0c4cf.png)

Short-term Disability Benefit Basics

Chapter 124 Disability Income Benefits Flashcards Quizlet

Ct Life And Health Guarantee Exam Flashcards Quizlet

Health Insurance Ohio Flashcards Quizlet

/GettyImages-1065978584-59f818c896ed4f83b756fccc0e540c31.jpg)

Company-owned Life Insurance Coli Definition

13 Disability Insurance Flashcards Quizlet

Xcel Ch 14 Disability Insurance Flashcards Quizlet

Hs326 Chapter 10 Employee Benefits Flashcards Quizlet

Accident Health Insurance Course Chapter Diagram Quizlet

/insurance-life-protect-help-secure-care-1576403-pxhere.com-015a0a012f484af2bfe5a897031015a2.jpg)

Key Person Insurance Definition