Expense Ratio Insurance Singapore

G3b) as mentioned, the nikko am sti etf is the other sti etf in singapore. The future at lloyd’s strategy should bring the circa 40 percent expense ratio at lloyd’s closer to parity with the global market at 30 percent, ceo.

Combined Ratio In Insurance Definition Formula Calculation Underwriting Financial Analysis Life Insurance Companies

Spdr sti etf expense ratio:

Expense ratio insurance singapore. Ad world class private health insurance for expats in singapore & beyond. Over 1 million hospitals, clinics and physicians worldwide. The combined ratio will add both underwritten claims made by its clients and expenses it occurred and dividing it by the total premiums earned during that period.

The expense ratio can be used to compare a company’s performance over a period of time. Great american insurance company as of december 31, 2020 (statutory basis; Insurance profit for the year ended 30

A ratio below 100% will mean that an insurance company is earning more revenue from writing premiums than it is shelling out in the form of expenses and vice versa. Insurance companies typically follow two methods for measuring their expense ratios: S$1,134 million *survival proceeds include maturity benefit, coupons, cash bonuses and annuity benefits.

The expense ratio in different regions may vary significantly depending on a few factors, including the difference in product preferences, which drives differences in commission rates. This calculator allows users to see the simplified effect of the expense ratio on their investment returns. Property and casualty insurance industry results (in millions, except for percent).

Nikko am sti etf (sgx: The trade method, where insurance companies divide their expenses by. The expenses can include advertising, employee wages, and commissions for the sales force.

Total expenses include investment, management, distribution, tax and other expenses. What does expense ratio mean? (direct insurers only) and kpmg analysis.

Expense ratio for the 12 months ended for the 12 months ended 30 september 2019 30 september 2018 1.69% 1.70% turnover ratio for the 12 months ended for the 12 months ended 30 september 2019 30 september 2018 17.02% 17.69% other material. Insurance profit $m 5,010 4,835 3,889 loss ratio 62.7% 63.5% 66% expense ratio 24.6% 24.8% 26.2% combined ratio 87.3% 88.3% 92.2% insurance margin 16.2% 16.0% 13.6% capital ratio 1.82 1.85 1.74 source: You should key two expense ratio figures for a comparison to be made.

Expense ratio for an insurer would be analysed by class of business, along with the trend of the same combined ratio loss ratio + expense ratio combined ratio is a reflection of the The expense ratio signifies an insurance. The expenses can include advertising, employee wages and commissions for the sales force.

The expense ratio in the insurance industry is a measure of profitability calculated by dividing the expenses associated with acquiring, underwriting, and servicing premiums by the net premiums earned by the insurance company. Get a quote for singapore. Funds the expense ratio should be calculated as follows:

Apra quarterly general insurance performance statistics june 2018. Expense ratio 0.0 pts 27.0% 27.0% 27.6% 27.8% 27.6% 28.1% 28.1% 27.9% 28.4% 28.2% combined ratio (4.8) pts 99.1% 103.9% 100.5%. The expense ratio in the insurance industry is a measure of profitability calculated by dividing the expenses associated with acquiring, underwriting and servicing premiums by the net premiums earned by the insurance company.

1.3 section 17(4) of the insurance act requires all income and expenses of the insurer to be properly attributable to the business to which the insurance fund relates, and the assets comprised in the insurance fund must be applicable only to meet such part of the insurer’s liabilities and expenses which are properly attributable to it. Total expense ratio is the proportion of total expenses incurred by the par fund to the assets of the par fund. Expense ratio refers to the percentage of premium that insurance companies use for paying all the costs of acquiring, writing and servicing insurance, and reinsurance.

The expense ratio signifies an insurance. Us dollars) gross written premium $5.3 billion net written premium $3.4 billion net earned premium $3.3 billion statutory loss & lae ratio 61% statutory underwriting expense ratio 31% statutory combined operating ratio 92% total statutory assets $9.8 billion Top 5 insurance companies in singapore.

The ntuc brand hardly needs any introduction. But you would definitely have heard of the top 5 insurance companies in singapore… ntuc income: There are hundreds(!) of insurance companies in singapore, so it’d be crazy to list them all out.

An expense ratio under 100% signifies that the insurance company is either earning or writing more premiums than it is paying out in expenses to. Ping an insurance 35,954,904 2.52% *the underlying fund is not authorised for public sale in singapore. View quarterly data for life and general insurance, including premiums, retention ratios, new business, business in force and net investment income.

However, if the same insurance company spends $2 million in operating the company, its expense ratio would be $2 million divided by $10 million = 20 percent. Administrative expenses can also differ by region due to cost of operations, investment in digitization, and general operating expenses.

Loss Ratio Of Cyber Insurance Premiums Us 2020 Statista

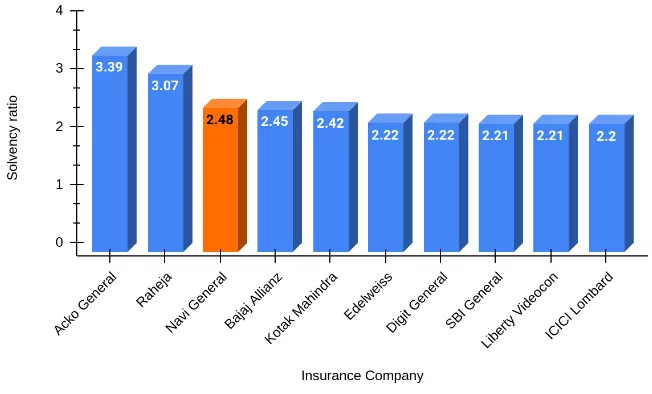

Navi Health Insurance - Reviews And Premium Calculator

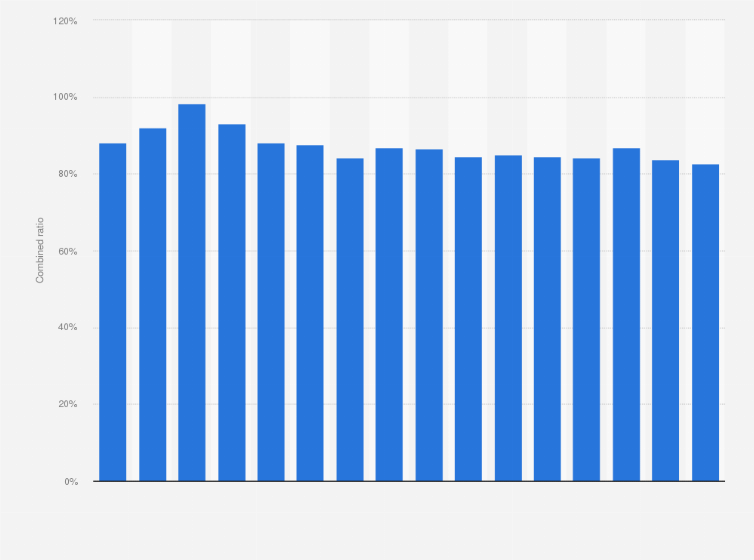

Tryg As Combined Ratio 2008-2020 Statista

India Own-damage Motor Insurers Combined Ratio 2019 Statista

What Is Persistency Ratio Importance Of Persistency In Insurance Sectoraegon Life Blog Read All About Insurance Investing

Most Stock Investors Wont Show You This - Youtube In 2021 Finance Investing Money Management Advice Finances Money

Life Insurers Balancing Act Only Gets Harder Prudential Singapore

Pin By Helena On Credit Money Management In 2021 Finance Investing Blog Planning Budgeting

Combined Ratio Of Pc Insurance Industry Us 2014-2019 Statista

Combined Ratio Of Pc Insurance Industry Us 2014-2019 Statista

What Is Persistency Ratio Importance Of Persistency In Insurance Sectoraegon Life Blog Read All About Insurance Investing

Lab21 Professional Music Software Lab21 Online Tienda Virtual Wwwlab21onlinecom Software A La Medida Investing Gold Investments Where To Buy Gold

Top 10 Life Insurance Companies Claim Settlement Ratio Latest Life Insurance Claim Settlement Ratio Of Companies In 2021 In 2021 Life Insurance Companies Medical Health Insurance Life Insurance

Best Earthworks Construction Company Financial Analysis Financial Financial Statement Analysis

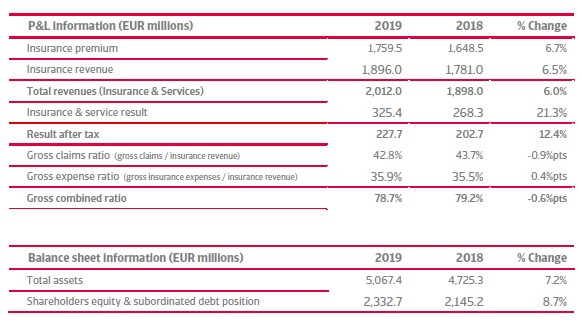

Press Release Atradius 2019 Year-end Result Increases 124

Spend Less Earn More Tag A Friend Who Need To See This Follow Escape_frugality For Mo Money Management Advice Money Financial Business Money

6 Ways To Increase Your Business Cashflow Life And Health Insurance Accounting Services Cash Flow

How To Budget As A Freelancer - Managing Expenses With Variable Income - Remote Life Genius Work Budgeting Best Budgeting Tools Financial Management

Roce Of Europes Largest Insurance Companies 2018 Statista