Self Insured Retention Versus Deductible

The two concepts are often confused and/or use the terms interchangeably. The first is who is issuing your company “credit”.

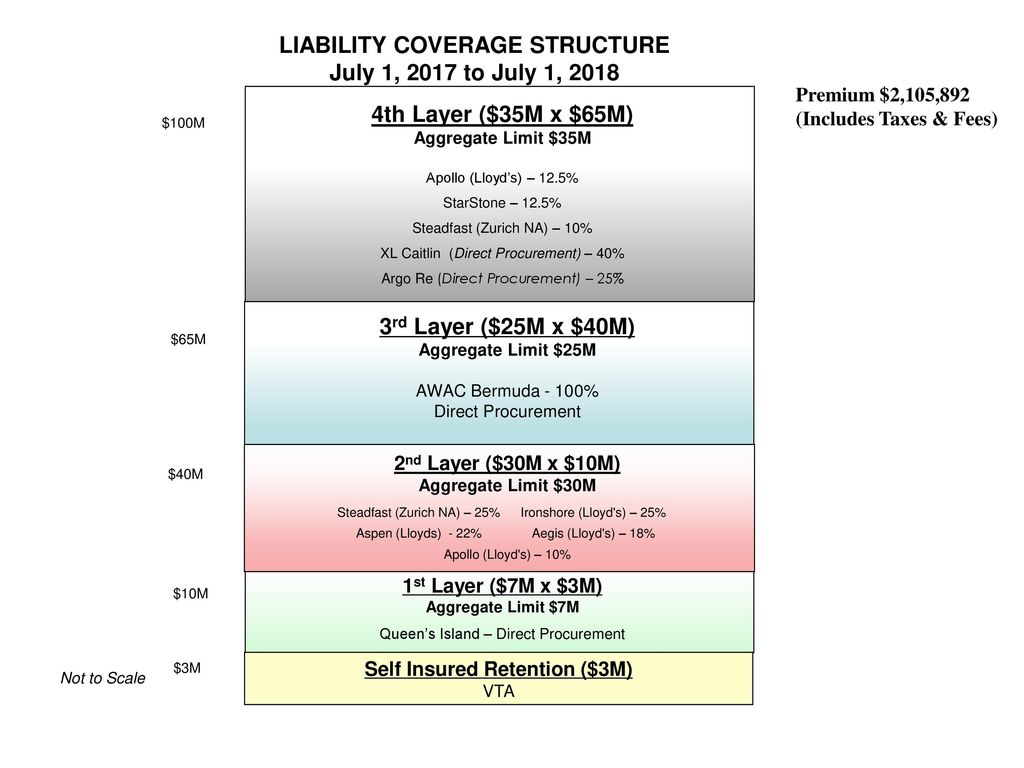

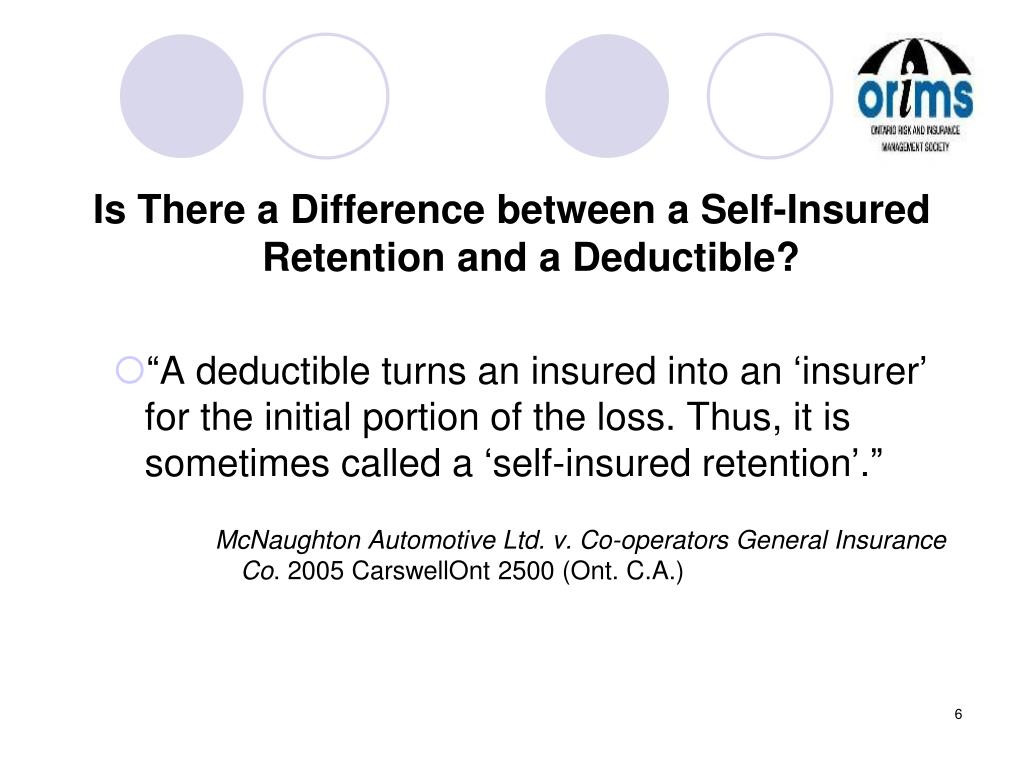

Liability Coverage Structure Self Insured Retention 3m - Ppt Download

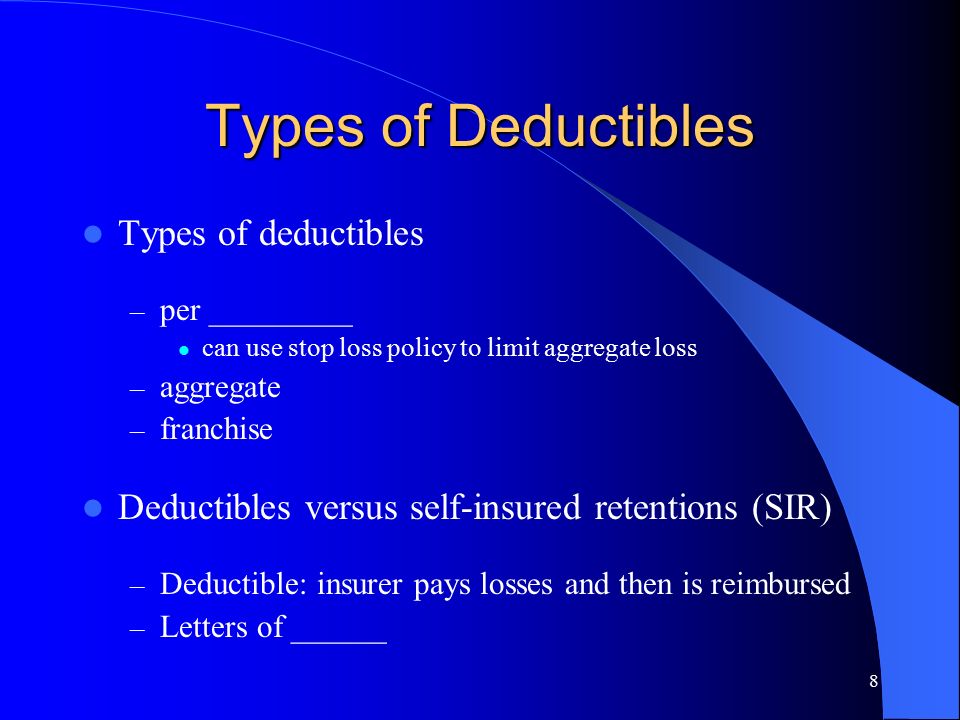

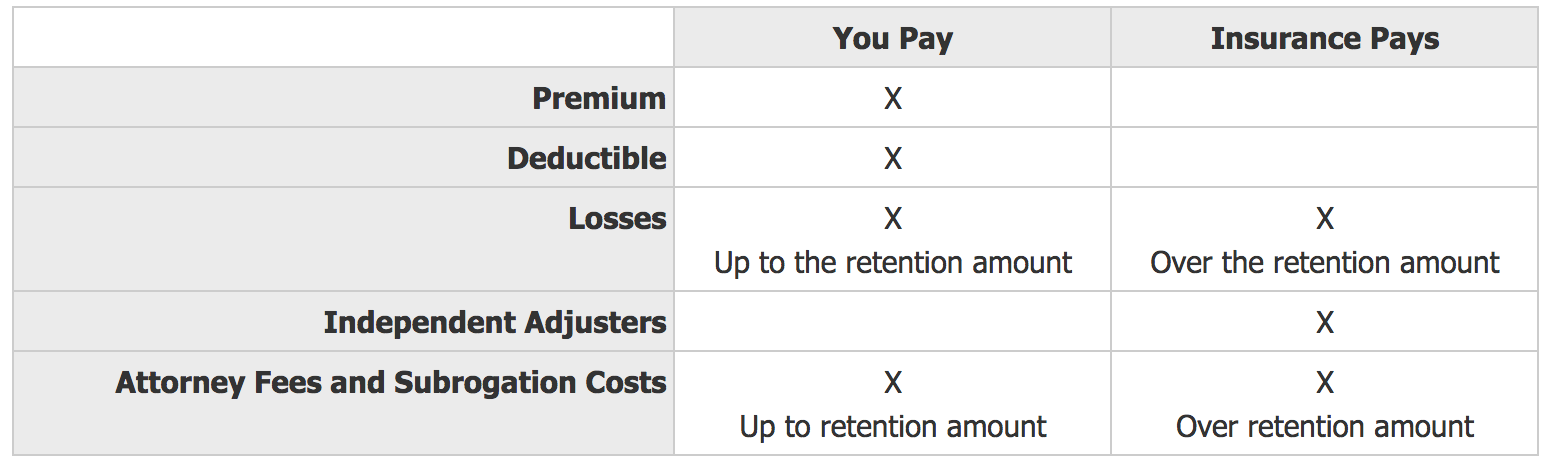

With a deductible policy, the insurer pays for losses and then collects reimbursement from you afterward up to the amount of the deductible.

Self insured retention versus deductible. After they have paid the bill, they will charge you for the money they spent up to the amount of your policy’s deductible. With a policy with a retention clause, you take the lead in paying a claim up to your retention limit. With a deductible, the insured notifies the insurer when there is a claim.

And then charge or bill back the deductible amount to the insured. Self insured retention vs high deductibles. In other words, the “deductible” is a sum that is subtracted from the insurer’s indemnity and/or defense obligation under the policy.

The insurer provides immediate defense, pays for any losses incurred and then collects reimbursement from the policyholder after the claims is closed, up to the deductible amount. Posted on thursday, february 6, 2014; Although these two mechanisms are economically similar, they differ in significant respects and should not be used interchangeably.

With a deductible, it’s the insurance company. The policyholder who wants their insurance company to provide legal defense for the insurance claim from the outset may prefer a deductible, other things being equal. There are also some important differences.

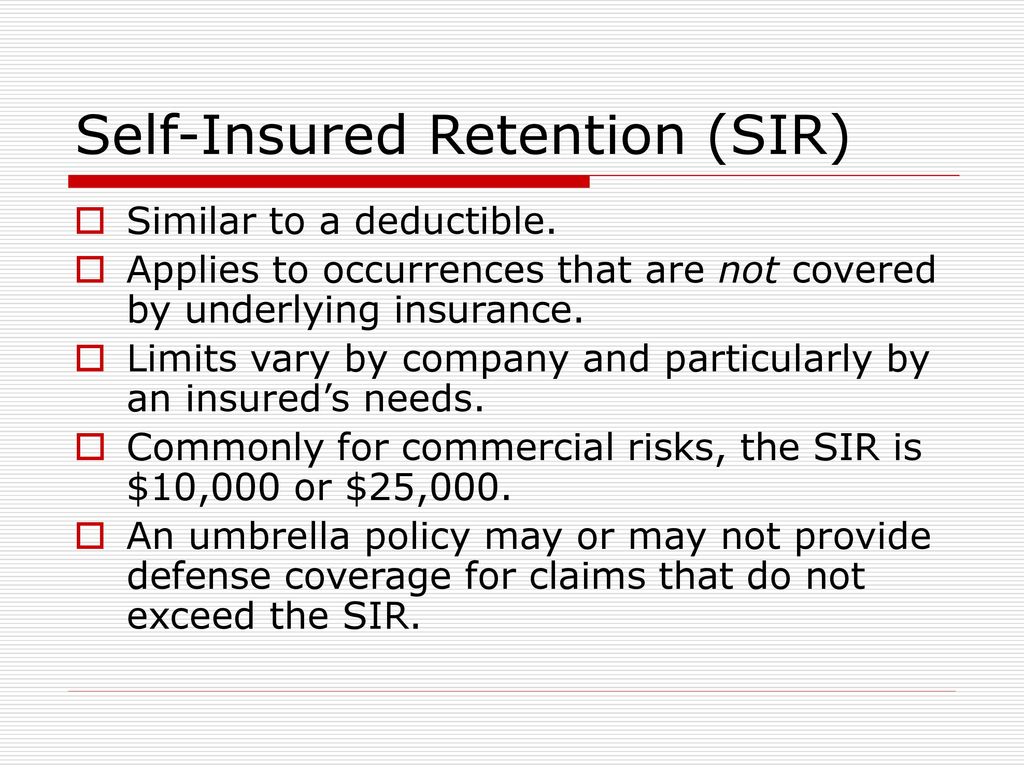

October 15, 2008 by writer. Deductibles and self insured retentions (sir’s) are mechanisms which require the insured to bare a portion of a loss otherwise covered by an insurance policy. These become increasingly important the larger the amounts become.

When a claim needs to be paid out, it’s the insurance carrier that pays the. While some view these terms as essentially being interchangeable due to their overall concept being similar, there are some key differences businesses should be aware of. Under an sir, the insured is still required to notify the.

The insurance company steps in only after you’ve done that. Thus, under a policy written with a sir provision, the insured (rather than the insurer) would pay defense and/or indemnity costs associated with a claim until the sir limit was reached. Importantly, the responsibility for the defense and.

Self-insured Risks - Captive Insurance 101

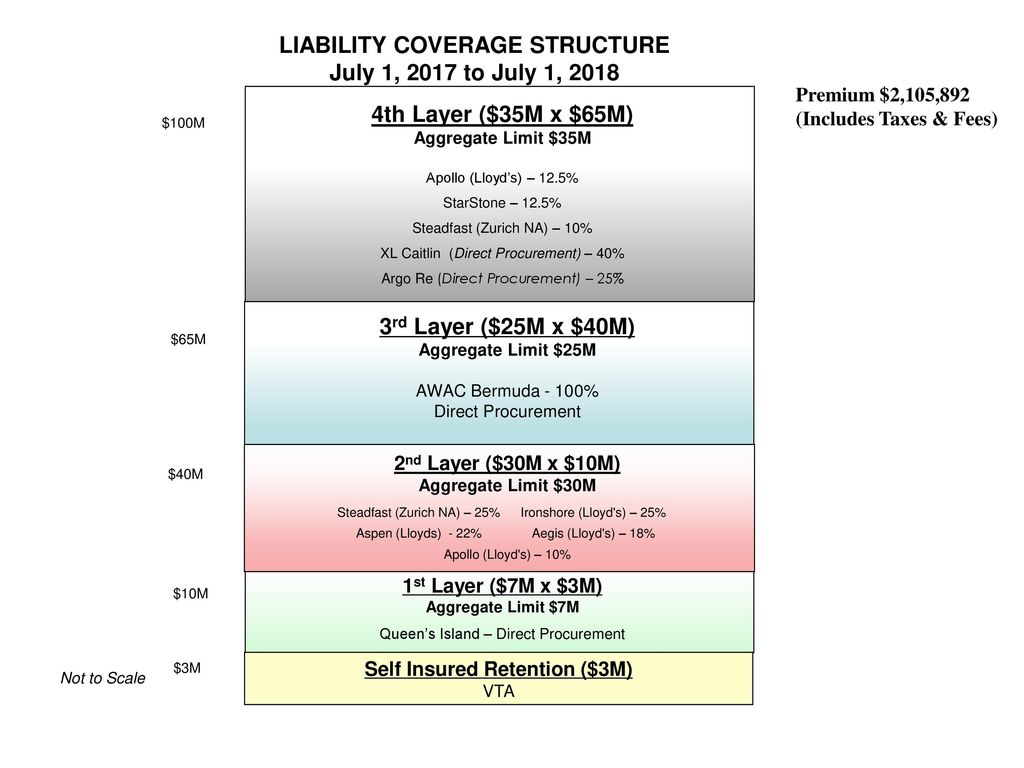

Fully-insured Vs Self-funded - Shenandoah Valley Group

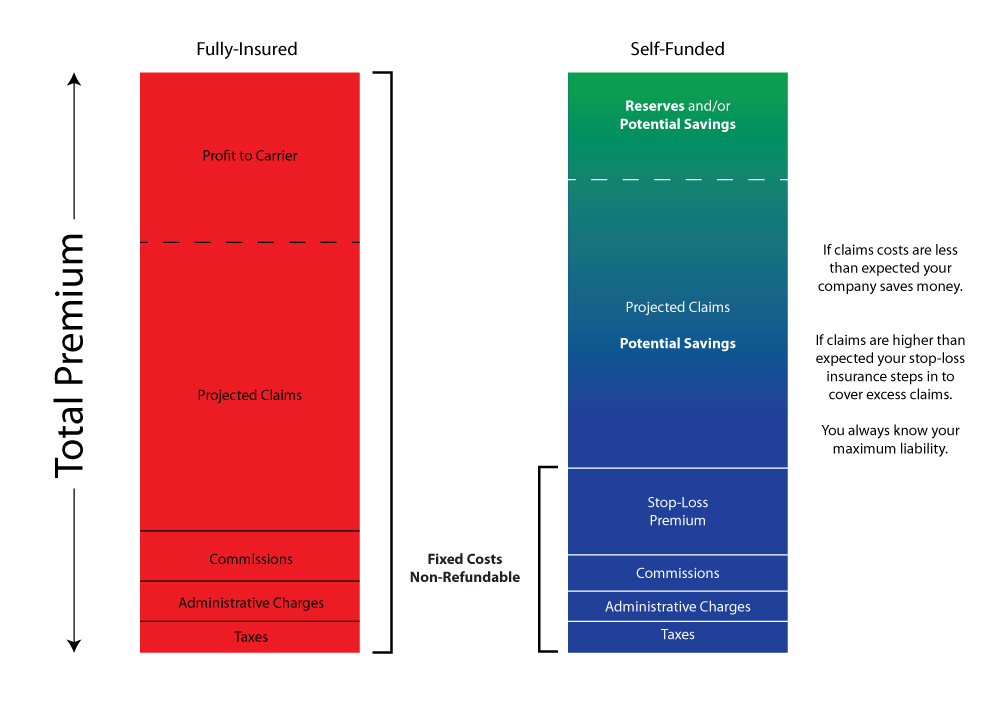

Ppt - Sirs Deductibles And The Importance Of Policy Language March 9 2011 Powerpoint Presentation - Id3052586

Self-insured Retention V Deductible What Is The Difference And Why It Can Matter Bell Davis Pitt

Deductible Vs Self Insured Retention Sir Whats The Difference - Youtube

Excess Liability Vs Umbrella Liability - Ppt Download

The Corridor Self-insured Retention Expert Commentary Irmicom

Self-insured Retentions Versus Deductibles Expert Commentary Irmicom

Liability Coverage Structure Self Insured Retention 3m - Ppt Download

1 Chapter Outline 111 Traditional Insurance Contracts Basis Of Coverage Deductibles And Self-insured Retentions Policy Limits Excess Policies Layering - Ppt Download

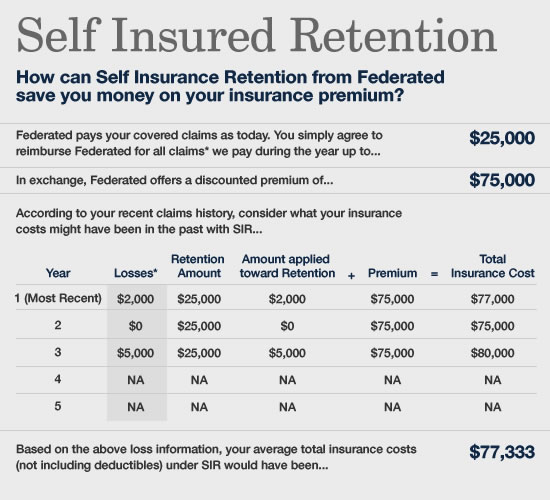

Sir A Profit Center For Your Business American International Automobile Dealers

Large Deductible Program Cash Flow Less On Premium Retained Losses Are Deductable Catastrophic Protection Pricing Driven By Individual Risk - Ppt Download

2

Managing Your Risk Self-insured Retentions Vs High Deductibles Propertycasualty360

Insurance Deductible Vs Self Insured Retention - Aligned Insurance

Deductibles Vs Self-insured Retention

Deductible Vs Self-insured Retention

Ppt - Sirs Deductibles And The Importance Of Policy Language March 9 2011 Powerpoint Presentation - Id3052586

Sir A Profit Center For Your Business American International Automobile Dealers