Define General Aggregate Insurance

The general aggregate limit is spelled out in the insurance contract and caps the number of covered losses for which an insurer will pay. While not often used in property insurance, aggregates are sometimes included with respect to certain catastrophic.

2

The insureds took a different approach.

Define general aggregate insurance. Let’s go over the basics about general aggregate limits in general liability insurance. The term is also known as “general aggregate limit of liability,” which is the maximum amount of money an insurance company will pay for claims, losses, and lawsuits that. Shall not exceed 20% (twenty per cent) of the sum of the contract price.

In commercial general liability insurance, the general aggregate is the maximum amount of money the insurer will pay out during a policy tenure. A general aggregate is a crucial term in commercial general liability insurance, which is necessary for all policyholders to understand. Aggregate limits define how much a policy will pay over the policy’s duration.

Assuming none of them individually cost more than £1m to fix, there's no shortfall. Cgl insurance policies carry liability limits, which means that during the term of coverage, the insurance will pay only up to a certain amount.once the policy reaches those thresholds, its financial resources are exhausted. Shall not exceed 20% (twenty per cent) of the sum of the contract price.

The aggregate limits are part of commercial general. That might represent a single large claim, or multiple smaller ones. Two important limits include “each occurrence” and “general aggregate”:

This is different than a per occurrence limit, which is the. General aggregate limit — the maximum limit of insurance payable during any given annual policy period for all losses other than those arising from specified exposures. This includes various types of insurance for individuals as.

What does ‘general aggregate’ mean in an insurance policy? A general aggregate is the maximum limit of coverage which applies to commercial general liability insurance policy. An aggregate limit is a maximum amount an insurer will reimburse a policyholder for all covered losses during a set time period, usually one year.

If your policy is any one claim, that same £1m level of cover applies to each of the three claims. The general aggregate limit on a cgl insurance policy defines the total amount the insurer will pay during a single policy period, usually a year. A general aggregate limit is the maximum limit of insurance payable during any given annual policy period for all losses other than those arising from specified exposures.

A general aggregate sets the limits of your commercial general liability (cgl) policy. The more you're willing to pay in premiums, the higher an aggregate limit you can obtain. Insurance policies typically set caps on both.

The general aggregate limit of an insurance policy is the maximum amount of money the insurer will pay out during a policy term. Under the standard commercial general liability ( cgl) policy, the general aggregate limit applies to all covered bodily injury (bi) and property damage (pd) (except for injury. Shall not exceed 20% (twenty per cent) of the sum of the contract price.

How commercial general liability insurance protects your business. Aggregate limits are commonly included in liability policies. Aggregate — (1) a limit in an insurance policy stipulating the most it will pay for all covered losses sustained during a specified period of time, usually a year.

This is different than a per occurrence limit, which is the maximum amount the policy pays out per claim levied against you within the term of your policy. This means that coverage will pay for every claim, loss and lawsuit that involves a policyholder, until it reaches that aggregate limit. Your general liability insurance sets a limit on how much it will pay out per claim.

Westchester argued that the term is commonly used in policies and means the maximum that applies to all underlying insurance. There's also an aggregate insurance coverage limit to the total amount the policy will pay off in one year. Under the standard commercial general liability (cgl) policy, the general aggregate limit applies to all covered bodily injury (bi) and property damage (pd) (except for injury.

General insurance is the umbrella term used by the insurance industry to describe all policies other than life insurance policies. If your aggregate level of cover is £1m, you’re looking at a £400k shortfall. For westchester, the case turned on its definition (or lack thereof) for “general aggregate” limit of liability.

This is different than a per occurrence limit, which is the. Most policy periods are one year. Also known as business liability insurance, general liability insurance protects you and your business from “general” claims involving bodily injuries and property damage.almost every business has a need for general liability insurance.

Under some commercial general liability (cgl) policies, the general aggregate limit applies to all covered bodily injury (bi) and property damage (pd) (except for injury or. Under the standard commercial general liability (cgl) policy, the general aggregate limit applies to all covered bodily injury (bi) and property damage (pd) (except for injury. General liability insurance can help cover medical expenses and attorney fees resulting from bodily injuries and.

In insurance terms, aggregate refers to the limit a policy will pay during a specified timeframe. The general aggregate limit places a ceiling on the insurer’s. The policy contract defines your coverage limits, parameters, and policy period.

Aggregate also is referred to as an aggregate limit or general aggregate limit. Under the standard commercial general liability (cgl) policy, the general aggregate limit applies to all covered bodily injury (bi) and property damage (pd) (except for injury. Under the standard commercial general liability (cgl) policy, the general aggregate limit applies to all covered bodily injury (bi) and property damage (pd) (except for.

Plus, as legal costs are covered separately, each claim effectively has a.

:max_bytes(150000):strip_icc()/bond-index-pie-chart-1024x683-ed9eb8562a7e4af8a3aa306890128382.jpg)

What Is The Agg Or Bloomberg Barclays Aggregate Bond Index

Age For Full Social Security Retirement Benefits Retirement Benefits Saving For Retirement Pension Fund

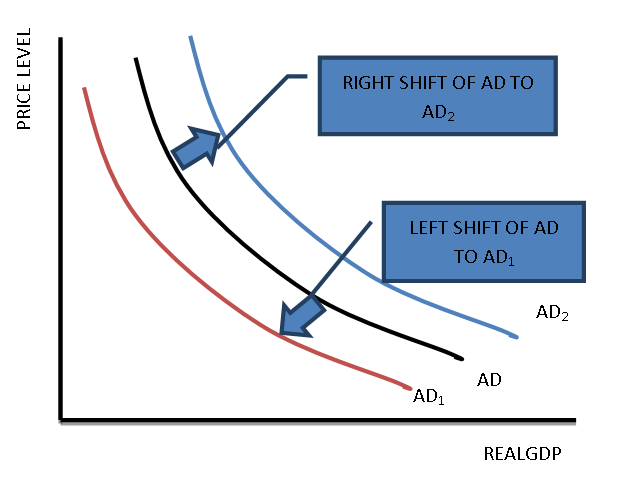

What Shifts Aggregate Demand And Supply Ap Macroeconomics Revie

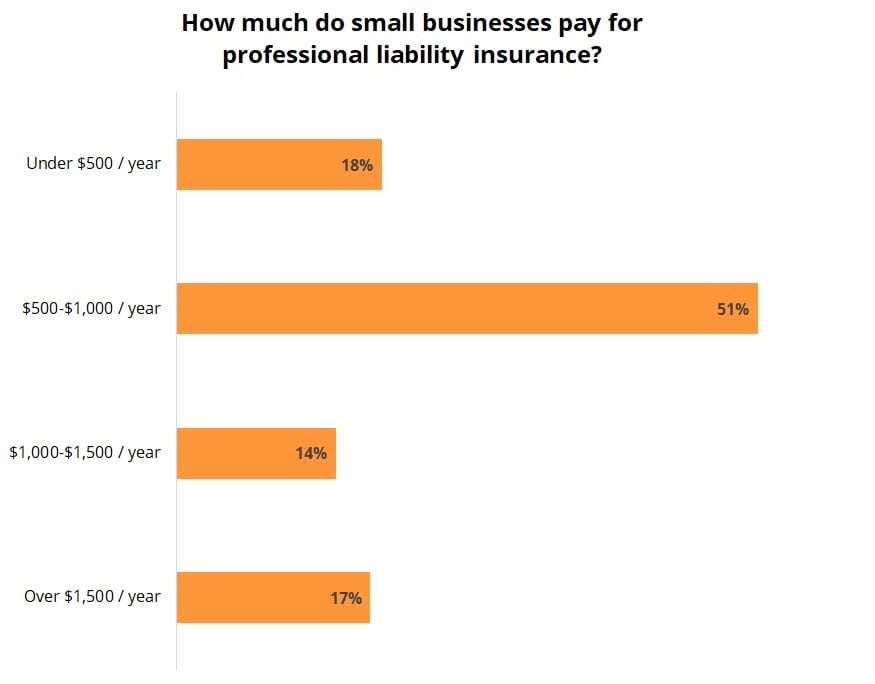

Professional Liability Insurance Cost Insureon

:max_bytes(150000):strip_icc()/UnemploymentGDP2008-d4bbacbf95774e82b327582298226f8a.jpg)

Aggregate Demand Definition

Conclusion From Dol Saving For Retirement Savings Strategy Pension Fund

Fruit Seeds Botanical Definition Seeds

Roads Are Made Up Of Four Layers These Include Layers Of Road Construction Sub-grade Road Construction Surveying Engineering Civil Engineering Construction

What Are Aggregate Limits And Per-occurrence Limits In My General Liability Insurance Policy

In The Aggregate Vs Any One Claim Whats The Difference Ashburnham Insurance

Net Realizable Value Definition Examples How It Works

Pin On Charltons

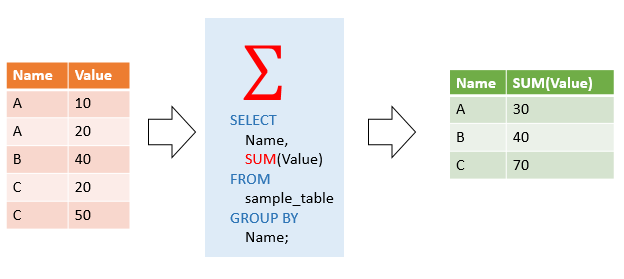

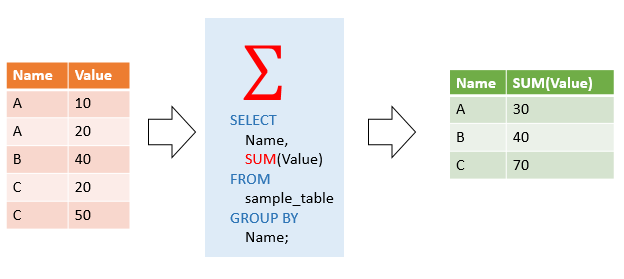

Mysql Aggregate Functions

Streams After 12th In 2021 Career Counseling Career Guidance Career Options

/BankLoandBizInv2008-d55dca8fadfd42c1b202e1e519d3f886.jpg)

Aggregate Demand Definition

Mysql Aggregate Functions

Definition Of Saving Is A Leakage - Google Search In 2021 Circular Flow Of Income Economics Aggregate Demand

/imitation-of-a-house-in-a-chain-on-a-lock-on-a-gray-piece-of-concrete-on-a-beige-pastel-background--1133455818-33c850555bb14795a46fade3d2e34a17.jpg)

Aggregate Limit Of Liability

:max_bytes(150000):strip_icc()/BankLoandBizInv2008-d55dca8fadfd42c1b202e1e519d3f886.jpg)

Aggregate Demand Definition