What Is A Credit Life Insurance Fee

Because lenders usually offer credit and disability life insurance when you obtain a loan, policies are either guaranteed acceptance or have incredibly limited underwriting. Term life insurance offers peace of mind.

Buy Or Renew Car Insurance Policies Online Buy Car Insurance Policy In Easy Steps Get 24x7 Spot Assistance Car Insurance Car Insurance Online Insurance Money

This is a fee that a credit provider charges you for servicing, administering or maintaining the credit agreement between you and the provider.

What is a credit life insurance fee. Credit life insurance can also be combined with asset or homeowners insurance cover. This means you are paying $100 per year for protection on a loan for which the benefits do not go to anyone else but the lender. If you’re wondering how this works, you’ve come to the right place.

What is the coverage of creditor protection insurance (cpi)? Ad are you worried about your future? In comparison, traditional term life insurance coverage worth $250,000 would cost between $141 and $491 annually, depending on the person’s age.

This means that you are covered for 12 months. As you can see, the shorter the term length, the cheaper the life insurance premiums you will have to pay each year. Before deciding to buy credit insurance, think about your choices and about the cost of this insurance.

Credit life insurance is a specific type of credit insurance that pays out if you die. The overcharging of consumers with credit life is rife and the new regulations are likely to cap the cost of credit life at r4.50 per month per r1 000 of cover. The average cost of credit life insurance is about $.50 for every $100 borrowed.

Other types of credit insurance repay loans in less extreme circumstances, such as involuntary unemployment. Credit life insurance is a type of life insurance policy designed to pay off a borrower's outstanding debts if the borrower dies. Credit providers can charge this on a monthly, annual or transactional

Let’s say that you took out a $20,000 auto loan for five years. So if you borrow 10,000 for a term of 12 months, you get a life insurance cover worth 12,000 for the whole term of the loan. Unethical dealers may mark up these types of additional insurance products 200% or more.

Checking or transaction account charges. Buying credit life insurance to cover a. Credit insurance can be more expensive than other types of insurance.

The average credit life insurance policy has coverage of around $5,600, according to hause actuarial solutions. Credit insurance is optional insurance that make your auto payments to your lender in certain situations, such as if you die or become disabled. Term life insurance rates by policy length.

Credit life and disability insurance are optional finance products a car dealership will offer you in the finance department. Credit life insurance is a policy designed to pay off a borrower's debt if the borrower dies. Unlike term or universal life insurance, it doesn’t pay out to the policyholder’s chosen beneficiaries.

Credit life insurance pays a policyholder’s debts when the policyholder dies. Creditor protection insurance covers 120% of the loan. While credit life insurance rates will depend on the loan amount, these types of insurance policies can cost more than traditional life insurance.

In this form of credit life insurance, a consumer is covered for an amount equal to the death benefit in the case of the insured being diagnosed with a dread disease such as renal failure, paraplegia, heart attack or loss of speech. Term life insurance offers peace of mind. Term life insurance that will give you peace of mind.

A charge imposed in connection with a credit feature on a checking or transaction account (other than a prepaid account as defined in § 1026.61) is a finance charge under § 1026.4 (b) (2) to the extent the charge exceeds the charge for a similar account without a credit feature. A universal life insurance policy from pacific life offers a minimum death benefit of $25,000 and the guaranteed minimum interest rate on this type of policy from pacific life is 3%. Some individual states have laws in place to keep dealers from marking up additional insurance products.

Of this total, credit life was $1.28 billion, credit disability was $1.43 billion, credit property $2.44 billion and credit unemployment was $41 million. Ad are you worried about your future? When you are applying for your auto loan, you may be asked if you want to buy credit insurance.

Such a product provides cover for accidental damage or. There’s no upfront fee, but there is an annual fee of $90 charged to pacific life universal life insurance policy holders. Insurers that do accept credit cards for recurring payments may charge an additional processing fee.

You’ll likely need to make recurring payments by check or bank transfer. According to the ccia, consumer credit insurance totalled $5.56 billion in net written premium in 2006. On the other hand, credit card payment protection insurance typically costs about 1% of your previous month's balance.

If you choose to buy credit insurance, your. There are multiple factors that impact how much a. Cash is never accepted as a form of payment.

Term life insurance that will give you peace of mind. The face value of a. Instead, the policyholder’s creditors receive the value of a credit life insurance policy.

Most life insurance companies only accept credit cards for your first premium payment.

Would You Want To Burden Your Family With Your Debts Let Life Insurance Pay For Them Any Life Insurance Quotes Life Insurance Facts Life Insurance Marketing

Did You Know That A Woman With A College Degree Will End Up Making 500000 Less Than Her Male C Retirement Planning Investing Infographic Life Insurance Tips

Credit Life Insurance Quote Life Insurance Quotes Home Insurance Quotes Travel Insurance Quotes

Pin On Insurance Industry

5 Year Simple Issue Term Insurance Vs Credit Life Cowart Insurance Term Insurance Money Savvy Financial Tips

Best Buy Credit Life Insurance Fee - Buy Car Insurance Online Australiabuying Home Insurance Life Insurance Facts Buy Health Insurance Dental Insurance Plans

Do Life Insurance Policies Affect Medicaid Eligibility Life Insurance Policy Universal Life Insurance Life Insurance Quotes

Educate Yourself The Time To Act Is Now Know Your Options And What You Can Qualify For Thetimeisnow Ins Life Insurance Policy Business Loans Student Loans

Pin By Drj Centeno On Wfg Financial Literacy Life Insurance Quotes Financial Motivation

List Of Tax-credit Income Investment Allowances Life Insurance Premium Tax Credits Success Business

Are You Covered Life Goes On Life Insurance Marketing Insurance Marketing Insurance

Personal Budget Categories Personal Budget Budgeting Budget Categories

Understanding Life Insurance Equotecom Life Insurance Quotes Life Insurance Types Life Insurance

The Primary Purpose Of Taking Life Insurance Plan Is To Protect Your Family And Provide Them Shelt Insurance Quotes Auto Insurance Quotes Life Insurance Policy

The Difference Between Banks And Credit Union Infographic Oak Tree Has Provided Lending Documents Forms And Disclo Credit Union Credit Union Marketing Union

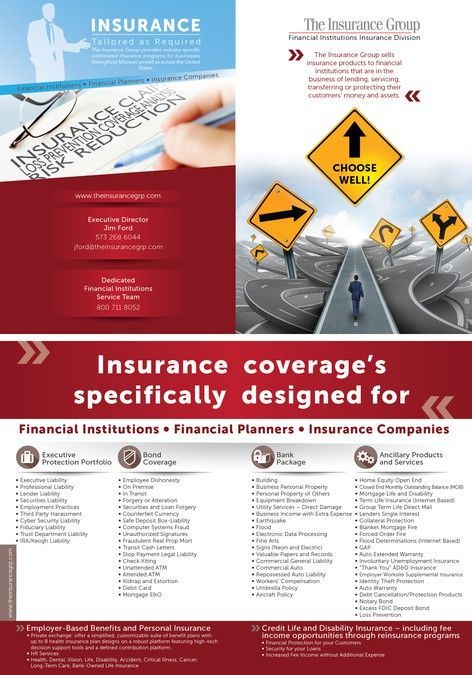

Create An Attention Getting Financial Institution Brochure For An Insurance Agency By Zeljko_radakovic Insurance Agency Financial Institutions Brochure

What Are The Consequences Of Not Having Life Insurance In 2021 Life Insurance Facts Life Insurance Marketing Life Insurance

Tips For Car Insurance Autoinsurance Life Insurance Agent Life Insurance Humor Car Insurance

8 Clear Reasons Why Life Insurance Is Important And Benefits - Creditcardglob Financial Decisions Permanent Life Insurance Life Insurance Policy