What Does 100 Replacement Cost Mean For Insurance

It pays for the replacement cost of your home and belongings. Replacement cost insurance is a coverage option for property insurance policies, especially homeowners insurance.

Infographic The Ultimate Car Repair Cheat Sheet Car Hacks Car Mechanic Car Maintenance

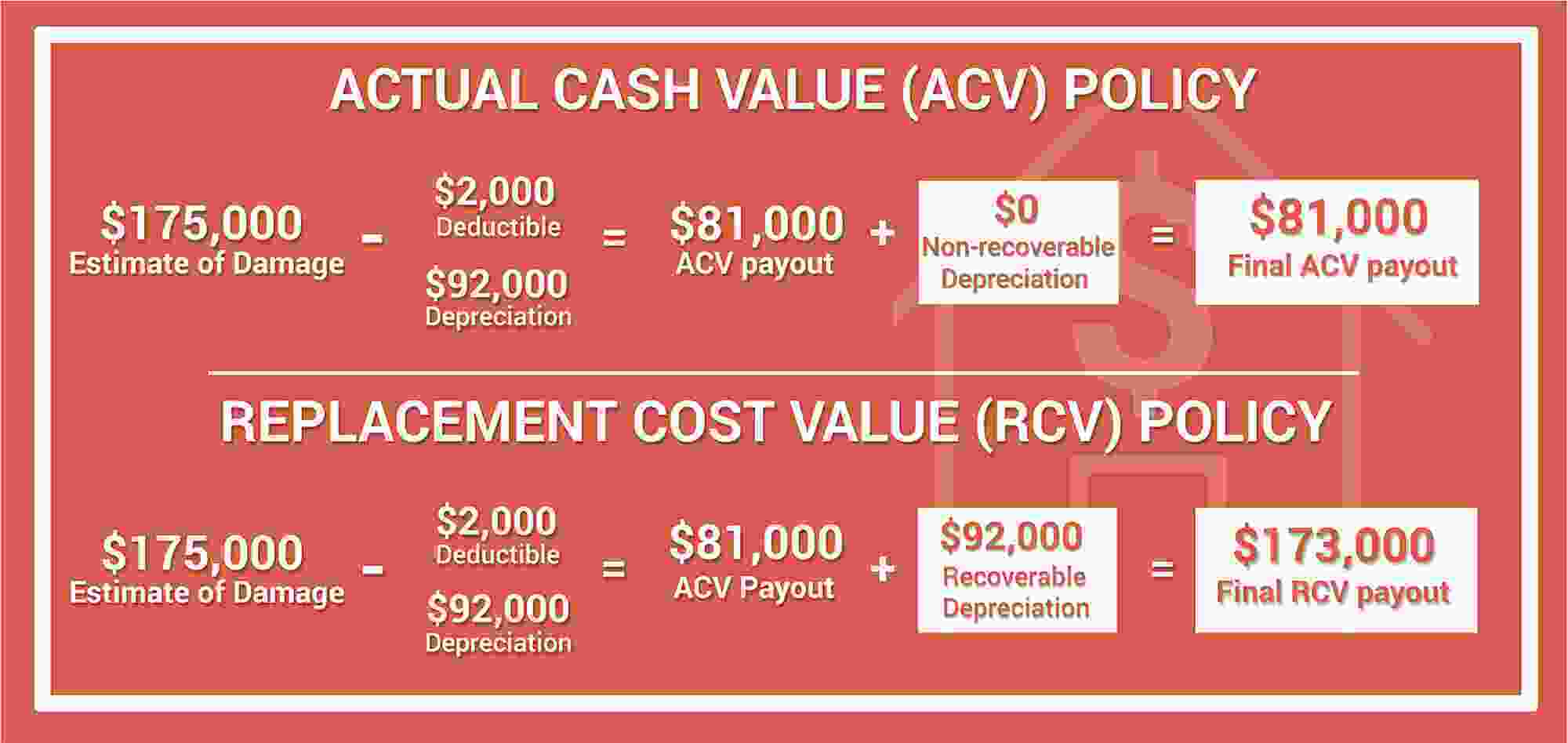

Replacement cost coverage — a property insurance term that refers to one of the two primary valuation methods for establishing the value of insured property for purposes of determining the amount the insurer will pay in the event of loss.

What does 100 replacement cost mean for insurance. Replacement cost insurance is designed to cover the costs of replacing your home and those contents covered under the policy, if they are severely damaged or destroyed. If you buy a new vehicle, the value of the car drops as soon as you drive it off the lot. Many bylaws require that you insure the buildings to 100% of the replacement cost.

This applies unless the limit of insurance or the cost actually spent to repair or replace the damaged property is less. It protects possessions like televisions, furniture, and more. (the other primary valuation method is actual cash value (acv).)

Most homeowners think that home replacement cost is the same as a home’s market value. What are the risks of replacement cost? In other words, it is the cost of purchasing a substitute asset for the current asset being used by a company.

Purchasing the right amount of home insurance is crucial for your peace of mind. In homeowners insurance, replacement cost is the amount it would cost to rebuild your home — or replace stolen or damaged belongings — without deducting depreciation from the claim reimbursement Replacement cost is the amount of money it would cost to rebuild your home as it was before if it’s destroyed, or to purchase brand new items if your old ones are damaged or stolen.

For the best protection, experts recommend that you insure your home for at least 100 percent of its estimated replacement cost. Most major home insurance companies offer extended replacement cost at an additional cost — typically an additional $25 to $50 annually, depending on if you go with 25% or 50%. What does “replacement cost” mean?

A replacement cost is an amount that it would cost to replace an asset of a company at the same or equal value. So, if your insurance policy includes replacement cost coverage for personal property, it should pay to replace your item—even at increased cost. Depending on the percentage you chose, your new coverage amount could be anywhere from $275,000 to $375,000.

Replacement cost is the amount of money required to replace an existing asset with an equally valued or similar asset at the current market price. This will result in the property being fully repaired, however the cost of labor and materials will be substantially less lowering the amount of coverage. Replacement costs can change over time, so you should review your homeowners policy annually to make sure its coverage meets your needs.

Inform your insurer if you have upgraded or improved your home, because these alterations. Guaranteed replacement cost — a property insurance valuation option found in some homeowners policies. The first place to look for answers is in your condominium bylaws.

Insure at 100% total insurable value and use 90% coinsurance. (however, if you live in close proximity to the coast or areas prone to natural disasters, your insurer may charge more for this endorsement.) This valuation method fully indemnifies the insured without any depreciation and without a maximum reconstruction payment.

Some insurance companies and policyholders have argued over just what constitutes “replacement cost.” Simply stated, it means the cost to replace the property on the same premises with other property of comparable material and quality used for the same purpose. In fact, new cars can lose up to 11% of their value upon purchase.

Yes, there is a discount on the rate, but it’s better to insure for 100% of the value and use an 80% coinsurance percentage—then you have a 20% cushion. The term “replacement cost” is defined or explained in the policy. One of the most important things to know when buying home insurance is knowing replacement cost insurance.

Functional replacement cost can be used as a solution in these situations by insuring and, in the event of a loss, rebuilding the property using modern constructions techniques and materials. Extended replacement cost insurance adds money to what you can draw from to rebuild, allowing you to afford these increased costs if such an event occurs. In the same scenario, if you pick dwelling limits of $120,000, you are covered for 75% of the $160,000 threshold.

100% replacement cost means that you have the correct amount of insurance to rebuild the association to the way it was before you had a loss. Replacement cost insurance covers the cost of replacing an item, even if the value of that item increases or the price goes up. It covers the cost to fully replace your personal property if it is damaged or destroyed by a covered loss.

This level of insurance is not included in every policy, and may not be available by all insurers. If the vehicle is stolen, replacement cost insurance will reimburse you for 100% of the value of a new car. Your replacement cost only covers the cost to rebuild your home.

Now, the expense cost varies from year to year, especially if you're looking at the cost to replace a home. Replacement cost coverage is one of two loss settlement valuation methods that insurance companies use to determine how much you’re owed on a claim. This left a potential gap of $10 million in coverage.

The policy pays the full cost of replacing the home even if this amount exceeds the policy limits. Now, your homeowners insurance policy will only cover 75% of the $50,000 in fire damage, or $37,500. This means if you have a building with a replacement cost value of $100,000 and an 80% coinsurance factor then you would only have to ensure it for.

Replacement cost on contents offers you extra coverage. For example, if your leather recliner is destroyed in a covered loss, replacement cost on contents coverage will pay. The risk is that you have no cushion if your replacement cost figures are not accurate.

When real estate markets are appreciating, it can often cost more to buy a resale or used home than to build a new home. Replacement cost is the amount of money it may require to replace a structure with a similar type of construction. How insurance covers you if you're below the.

Is Debt From Student Loans Still Worth A Degree Student Debt Student Debt Relief Online Business Classes

How Much Life Insurance Is Enough Life Insurance Life Insurance

Infographic Enervee Helps You Find The Greenest Home Appliances Energy Efficient Appliances Save Energy Home Appliances

Affordable Online Replacement Teeth Retainers Sporting Smiles Retainer Teeth Orthodontics Retainers Tooth Replacement

100 Scripts Tips Ch4 What Questions Do You Ask To Qualify A Lead Before You Present A Solution Medicare Supplement Insurance Sales Script

Determine Your Home Insurance Coverage With This Replacement Cost Vs Market Value Video Find Out More From State Home Insurance Homeowners Insurance Insurance

100 Scripts Tips Ch5 How Do You Explain The Benefits Of A Final Expense Policy Or The Benefits Of A Cheape Insurance Sales Final Expense Insurance

Homeowners Insurance - Downey Ca Los Angeles Ca - The Point Insurance Services Inc Homeowners Insurance Homeowner Content Insurance

Replacement Cost Valuercv Vs Actual Cash Valueacv

More Health-related Infographics Healthcare Infographics Infographic Health Health Care

Toyota 02-7fd35 02-7fd40 02-7fd45 02-7fdk40 02-7fda50 Forklift Trucks Parts Manual Forklift Toyota Manual

Pin On Living Room

Coast Capital Savings Wants Me To Take Out A Car Loan - The Lifestyle Digs Car Insurance Best Car Insurance Car Loans

Indemnity Form - Free Printable Documents Indemnity Cash Flow Statement Agreement

Doing Cost Benefit Analysis In Excel - A Case Study Excel Templates Analysis Excel

Meja Aquarium Minimalis Ikan Arwana Platinum Silver Aquarium Akuarium Mebel

Pin By Hanna Hammar On Kukhnya Vdol Okna Coffee Dripper Kitchen Cabinet Colors Wood And Steel

Pin On Dental Health

100 Scripts Tips Ch2 How Do You Handle Common Objections You Get From Telemarketed Leads S Insurance Sales Final Expense Insurance Script