What Does Face Amount Mean On A Whole Life Insurance Policy

The death benefit is the amount that is actually paid to the beneficiary when death occurs. The name comes from the fact that this amount is typically shown on the face or top sheet of the policy.

Aaa Life Insurance Review No-exam Policies And Discounts - Valuepenguin

The cash value is often stated on the top sheet of the policy, hence the name face amount.

What does face amount mean on a whole life insurance policy. A whole life policy provides a set amount of coverage for your entire life. Both the cash value and face value are different in terms of how their monetary amounts are determined. Therefore, the face value is also referred to as the death benefit.

Adjustable life insurance — also known as flexible premium adjustable life insurance or even just flexible life insurance — is a type of universal life insurance that lets you change certain facets of your policy. The face amount and death benefit are the level over time and do not change. Here are the key points to remember about modified premium life:

The death benefit in a whole life insurance policy is usually an amount that is specified in the policy contract. In other words, it amounts to the total value paid once the policy matures, the policyholder passes on, or if the holder of the insurance coverage. Whole life and universal life policies are considered permanent life insurance because they will provide coverage for the lifetime of the insured.

The amount of cash surrender fees and charges that the insurance company will assess in order to liquidate the policy. Face amount is the gross total amount of cash quantified in an agreement or insurance policy. The amount of accumulated funds at any given time is referred to as the cash value.

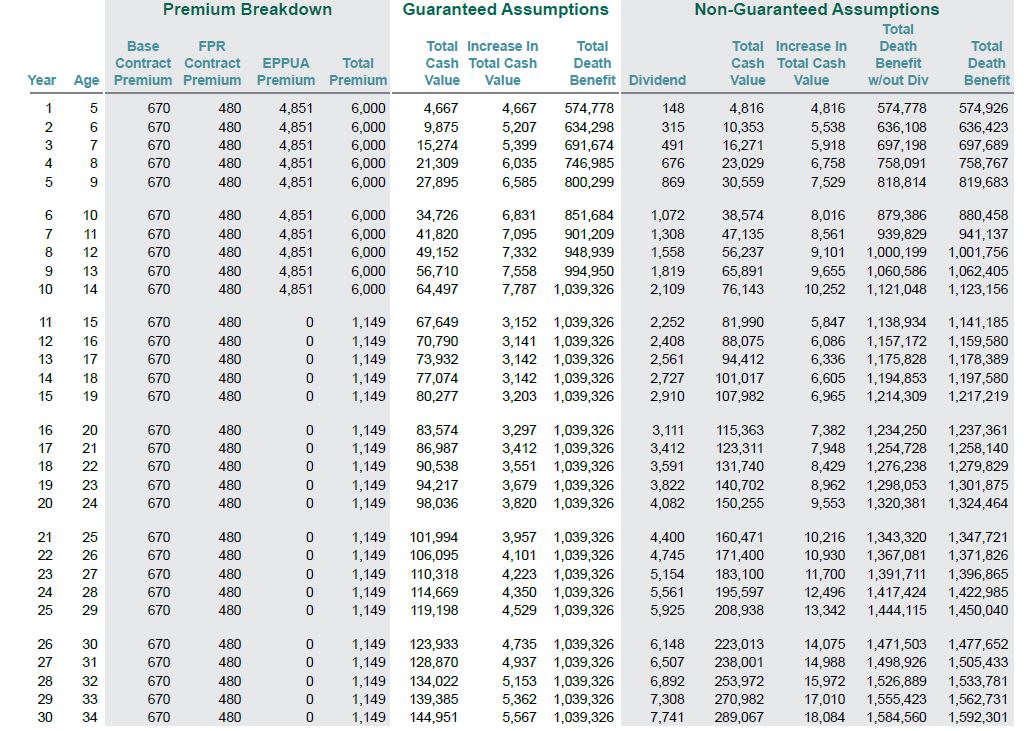

Only permanent life insurance policies, such as whole life and universal life, have a cash value account. The face amount in life insurance means the amount of insurance you buy. If the policy is eligible for dividend payments, the policyholder may choose to use the dividends to purchase additional death benefit, which will increase the death benefit at the time of the insured’s death.

A modified premium life insurance policy is mutually beneficial to both the owner and the life. Otherwise, the policy is the same as regular whole life insurance. Suicide is still covered by life insurance — if the insured dies outside of the defined term in the policy’s suicide clause, the insurance company will pay out the death benefit.

Ad worry less about the future with term life insurance. The amount of interest, dividends or capital gains that have been earned by the cash value in the policy. There are three major benefits the face amount of a life insurance policy provides the insured.

As long as you pay premiums, your beneficiary will receive the benefit amount upon your death. The amount of money that your insurance provider puts toward the policy is known as the face value and is the amount that will be paid out to. As mentioned above, whole life policies also build up “cash value” from.

The face value of a life insurance policy is the death benefit, while its cash value is the amount that would be paid if the policyholder opts to surrender the policy early. First is the peace of mind the insured gains knowing that he/she has protected his/her loved ones or financial interests by having the death benefit in place. In the case of whole life insurance the face amount is the initial death benefit that can fluctuate for numerous contractual reasons.

It is used for life insurance policies. The face value is the amount of insurance proceeds the policy pays to your beneficiaries upon your death. Cash value and face value are two elements that make up a permanent life policy.

It’s the amount of death benefit purchased, which indicates the amount of money the policy will pay to the beneficiary or beneficiaries when the insured person dies. The face amount almost always equals the death benefit in term insurance. To determine the face value of your policy, review it.

Don’t delay on getting term life insurance. The premium is lower in the early years and rises in later years. These charges can remain in effect for as long as 10 or 15 years after purchase in some cases.

A whole life insurance cash surrender value on a policy with a face value of $275,000 after 15 years might be as much as $21,000 depending on how well the investment fund has performed. If you already have other life insurance or are able to switch to a less costly term life policy, cashing in may be the best option for you. Don’t delay on getting term life insurance.

The insurance face amount is the sum that a life insurance policy will pay upon the occurrence of a qualifying event. In the case of a typical level term life insurance the face amount is the amount of insurance for the guaranteed length of time. A provision in most life insurance policies that allows the life insurance company to withhold the death benefit payout if the policyholder dies by suicide within the first year or two of the policy.

The face value, or face amount, of a life insurance policy is established when the policy is issued. Ad worry less about the future with term life insurance.

Pin By Yamya Johnson On Food For Thought Life Insurance Quotes Good Life Quotes Life Insurance Facts

What Is Life Insurance And How Does It Work Money

How Much Life Insurance Do You Need Forbes Advisor

What Is No-exam Life Insurance And How Does It Work Money

Choosing A Life Insurance Policy - Video Lesson Transcript Studycom

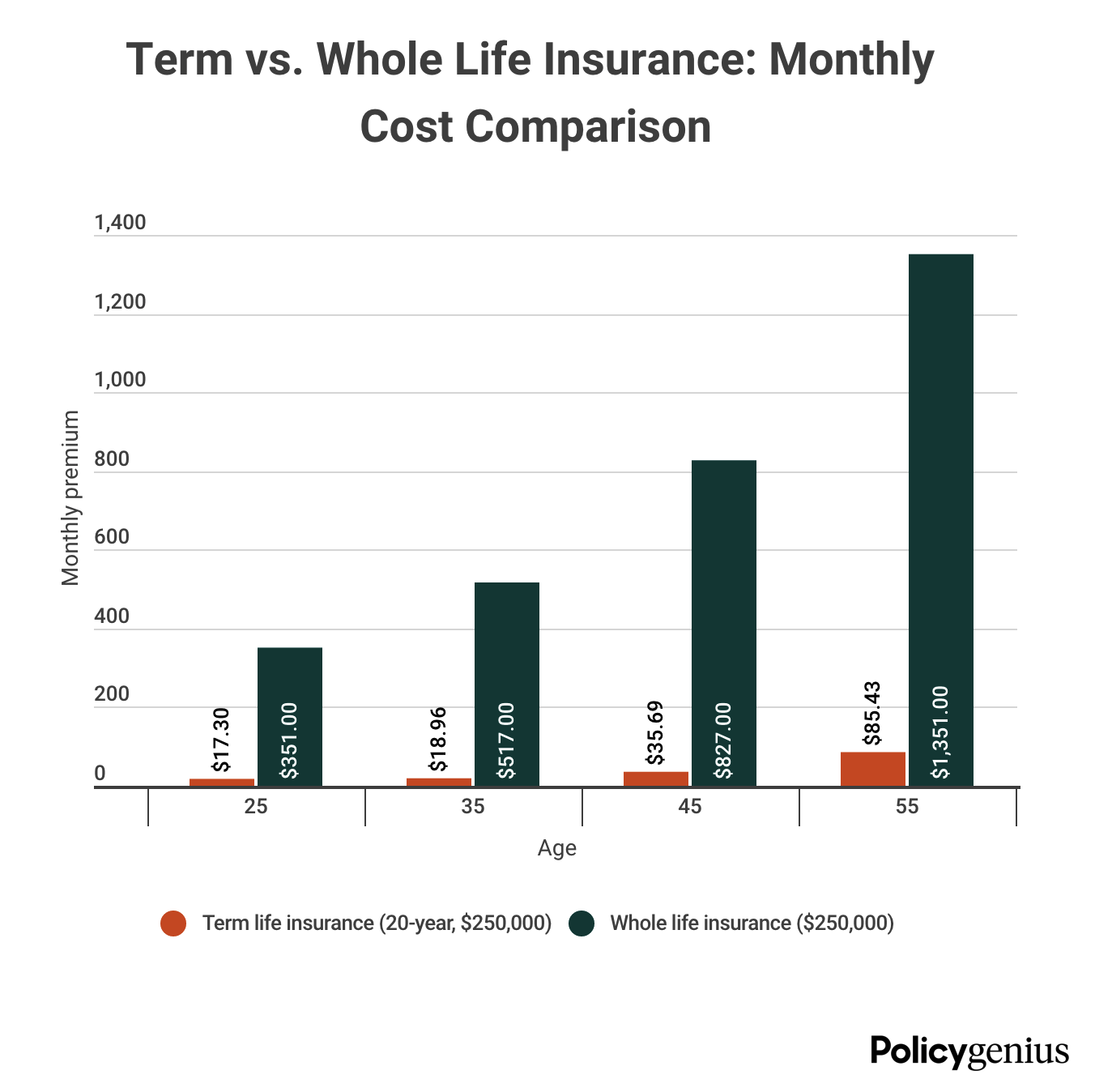

Term Vs Whole Life Insurance Policygenius

Life Insurance For Children The Best Policy For Your Kids

Term Insurance Calculator Helps You To Calculate Online Term Insurance Premium Payable For Life Insurance Calculator Life Insurance For Seniors Term Insurance

How Does Whole Life Insurance Work Costs Types Faqs

/GettyImages-1199059338_journeycrop_lifeinsurance-d3498103ef78406991ea4b4a7b401266.jpg)

Life Insurance Guide To Policies And Companies

Senior Life Insurance Various Types And Sample Rates For Each By Age In 2021 Life Insurance For Seniors Term Life Insurance Quotes Life Insurance Quotes

8 Best Life Insurance Companies Of December 2021 Money

Guide To Universal Life Insurance Nextadvisor With Time

/GettyImages-1134608493-a72c93c4adc34ee3b5a1c6e54dffa379.jpg)

Whole Life Insurance Definition

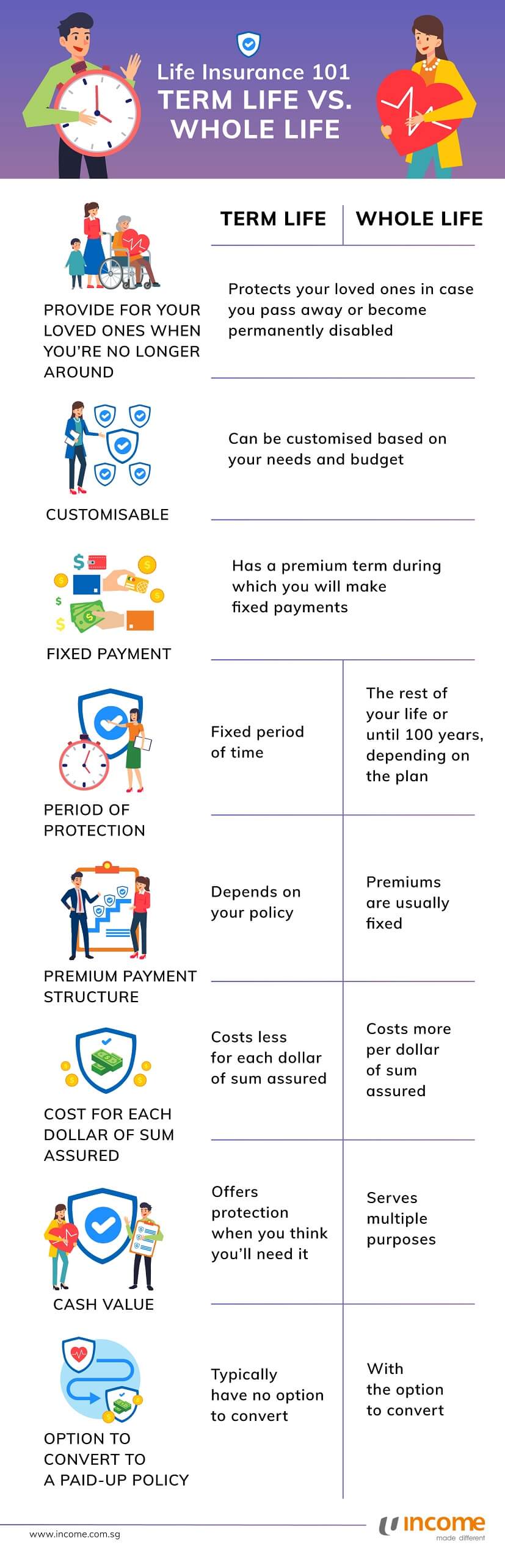

Whole Vs Term Life Insurance Ntuc Income

Life Insurance Over 70 How To Find The Right Coverage Life Insurance Quotes Term Life Insurance Quotes Term Life

Guide To Buying Life Insurance For Parents - Elderly Burial

Life Insurance Claim Form Whole Life Insurance Insurance Policy Life Insurance Facts

Best Life Insurance For Seniors