Purchasing Credit Life Or Disability Insurance Is Quizlet

Safeguard your finances—and peace of mind—against unexpected events or disability. Term life insurance made easy.

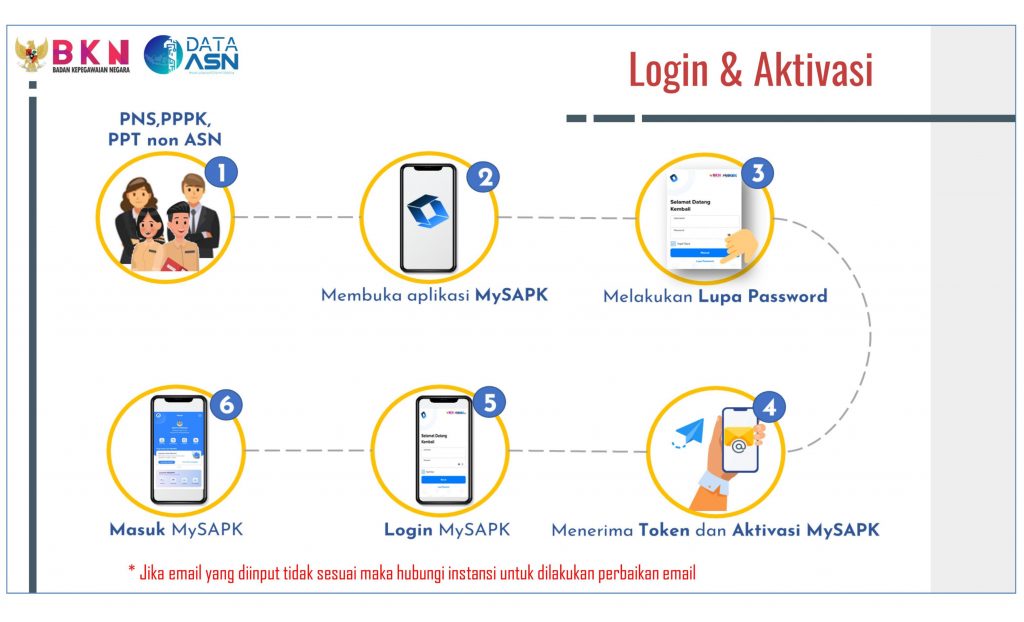

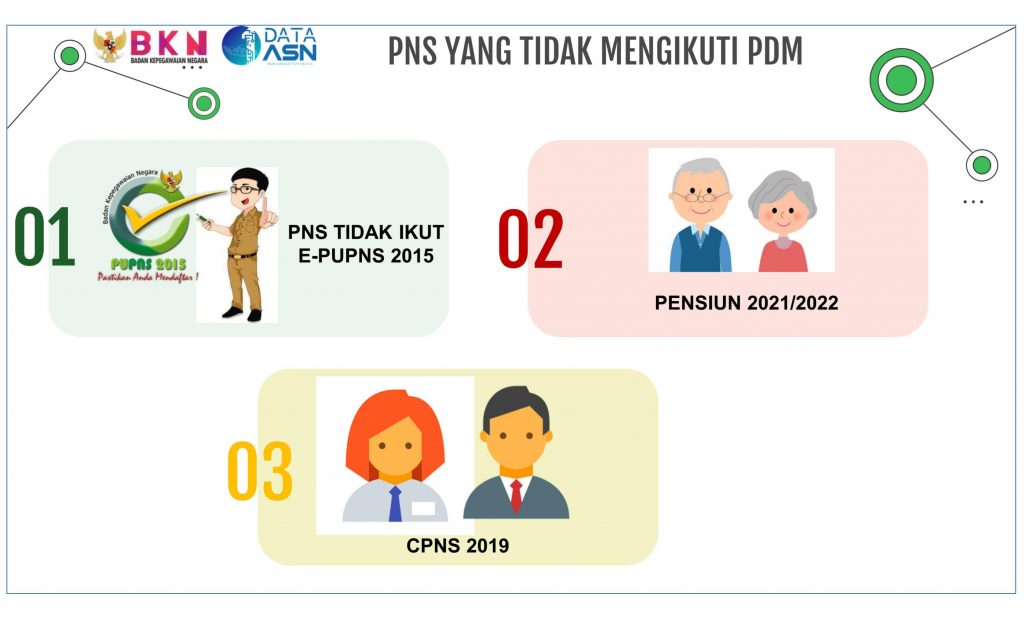

Pemutakhiran Data Mandiri Pdm Pemerintah Provinsi Kalimantan Tengah Bkd Kalimantan Tengah

Credit life insurance, which pays off all or some of your loan if you die.

Purchasing credit life or disability insurance is quizlet. Types of debt you could pay off with credit life insurance include: This policy is issued through an insurance company that the lender partners with. Credit life insurance and credit disability insurance are the most commonly offered forms of coverage.

Globally, it is by far the most common. Credit insurance is a type of insurance that pays off one or more existing debts in the event of a death, disability, or in rare cases, unemployment. A program managed by the social security administration that insures a worker in case of a mishap.

They also may go by different names. Credit life insurance is life insurance designed to pay off specific debt in the event of death, unemployment, illness or another event that may inhibit your ability to pay. There are four main types of credit insurance:

If a person is required to purchase credit life and/or credit disability coverage for a credit transaction, that person can provide the coverage through existing insurance, or can procure insurance on his/her own. Ad term life insurance your way. The purchase of credit life and credit disability is voluntary and can be cancelled at any time.

Sometimes referred to as payment protection insurance, the goal of credit life insurance is to pay off your debt — such as a home loan or credit card debt — in the event of your passing. Pays monthly disability payment up to $650 in the event the borrower is disabled prior to age 66. Terms in this set (30) credit life insurance.

Disability insurance provides an income replacement if you incur a disability and cannot work. Credit property insurance covers property used to secure a loan, such as a boat or car. Different types of policies cover other events, such as death, disability, or loss of property.

Credit disability insurance, also known as accident and health insurance, which makes payments on the loan if you become ill or injured and can't work. Insurance on life of debtor pursuant to specific loan or other creditor. Credit life insurance is a policy designed to pay off your loan in the event of your death.

Benefit is retroactive back to the first date of disability. Insurance coverage (s) cost per $100 of your monthly loan balance. These types of additional insurance products are optional to the consumer and are not.

Credit accident and health insurance. Credit life insurance provides cover in the event of you having outstanding debt when you die. Credit life insurance together with disability insurance, credit life insurance may help reduce or pay off your covered loan, up to the policy maximum, in the event of untimely death.

When you take out a loan, the lender may offer you a credit life insurance policy. As the balance of the loan decreases,. You can purchase credit insurance from your card lender that will cover your payments or pay off your balance if you can't make your payments due to a layoff or illness.

If purchasing a separate disability insurance policy is not feasible, you can add disability. Just what is credit life insurance? Credit life insurance is insurance on the life of the debtor which provides, in the event of the debtor's death, that the insurer will pay to the creditor the scheduled, unpaid balance.

Disability insurance offers income protection to individuals who become. Credit life insurance can be purchased when getting a loan for a vehicle (such as a car or truck), mortgage, or unsecured debt including credit card debt. Single credit life insurance and single credit disability insurance.

Coverage is only applicable if property is damaged or destroyed during the period of the loan. It usually also pays out if you are disabled or retrenched. Credit life policies are not only available on car loans, but for such purchases as furniture, appliances and trucks.

Credit life and disability insurance are optional products offered by car dealerships and lending institutions to pay off your auto loan in the case of death or disability. Credit life insurance is a form of term life insurance. Term life insurance made easy.

Disability insurance can reduce or pay off your covered loan, up to the policy maximum, in case of a covered life event or disability. Ad term life insurance your way. Council of life insurance, insurance fact book 1979 34 (1979);

A creditor cannot require borrowers to use a particular insurer. Protection in the event you are unable to perform the functions of your occupation, that are caused due to medical reasons or by becoming disabled due to an accident. Insurance on debtor to provide indemity for payments becoming due on a specific loan or other credit transaction while debtor is disabled.

Credit life insurance credit life insurance is designed to pay off or reduce a loan in the event of a borrower’s death, due to a covered sickness or injury as defined by the certificate or policy of insurance provisions. If you apply for life insurance and disability insurance at the same time, you can use the lab results from your medical exam for both insurance applications.

Langkah-langkah Aktivasi Akun Mysapk Bkd Kalimantan Tengah

Langkah-langkah Aktivasi Akun Mysapk Bkd Kalimantan Tengah

/insurance-life-protect-help-secure-care-1576403-pxhere.com-015a0a012f484af2bfe5a897031015a2.jpg)

Key Person Insurance Definition

Tlv Dealer Docs Flashcards Quizlet

Grade 9-12 Subject Economics Personal Finance Fourth Nine Weeks Instruction Dates April 14 June 15 - Pdf Free Download

Life And Health Flashcards Quizlet

Chapter 7 Finance Flashcards Quizlet

Life And Health Flashcards Quizlet

Grade 9-12 Subject Economics Personal Finance Fourth Nine Weeks Instruction Dates April 14 June 15 - Pdf Free Download

Tlv Dealer Docs Flashcards Quizlet

Grade 9-12 Subject Economics Personal Finance Fourth Nine Weeks Instruction Dates April 14 June 15 - Pdf Free Download

Health Disability And Long-term Care Insurance Flashcards Quizlet

13 Disability Insurance Flashcards Quizlet

Understand The 5 Cs Of Credit Before Applying For A Loan Forbes Advisor

Grade 9-12 Subject Economics Personal Finance Fourth Nine Weeks Instruction Dates April 14 June 15 - Pdf Free Download

Grade 9-12 Subject Economics Personal Finance Fourth Nine Weeks Instruction Dates April 14 June 15 - Pdf Free Download

Grade 9-12 Subject Economics Personal Finance Fourth Nine Weeks Instruction Dates April 14 June 15 - Pdf Free Download

Langkah-langkah Aktivasi Akun Mysapk Bkd Kalimantan Tengah

Grade 9-12 Subject Economics Personal Finance Fourth Nine Weeks Instruction Dates April 14 June 15 - Pdf Free Download