Subcontractor Default Insurance Zurich

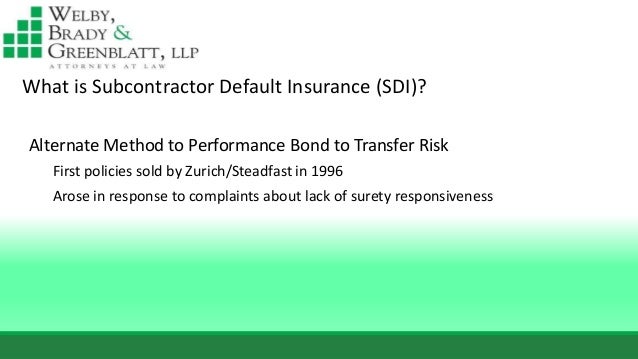

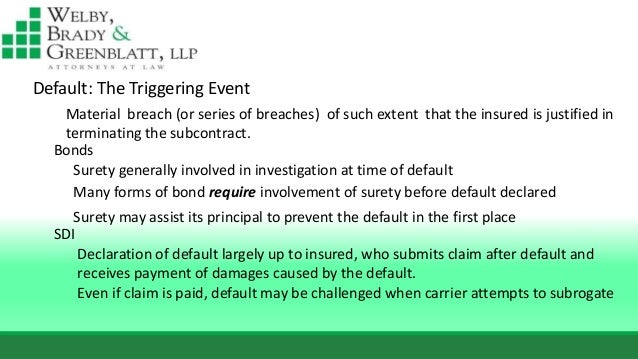

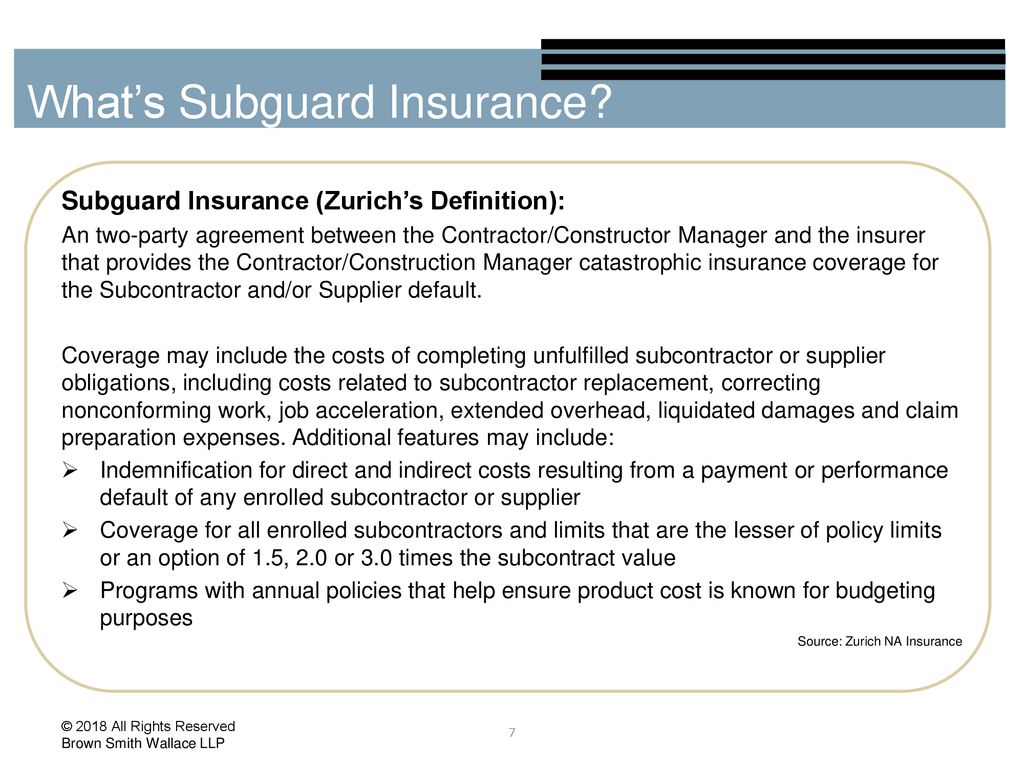

Subcontractor default insurance provides for coverage up to policy limit determination of default. Subcontractor default insurance, which allows contractors to insure against noncompletion of work or defaults by subcontractors, was launched about 25 years ago by zurich insurance ltd.

Performance And Payment Bonds Vs Subcontractor Default Insurance

It protects a project from delays and additional costs associated with a defaulted subcontractor or supplier.

Subcontractor default insurance zurich. The year ahead is likely to usher in a new era in subcontractor default insurance, or sdi. There’s good news to share for those in the commercial construction trade: Arch surety and a few other surety companies have.

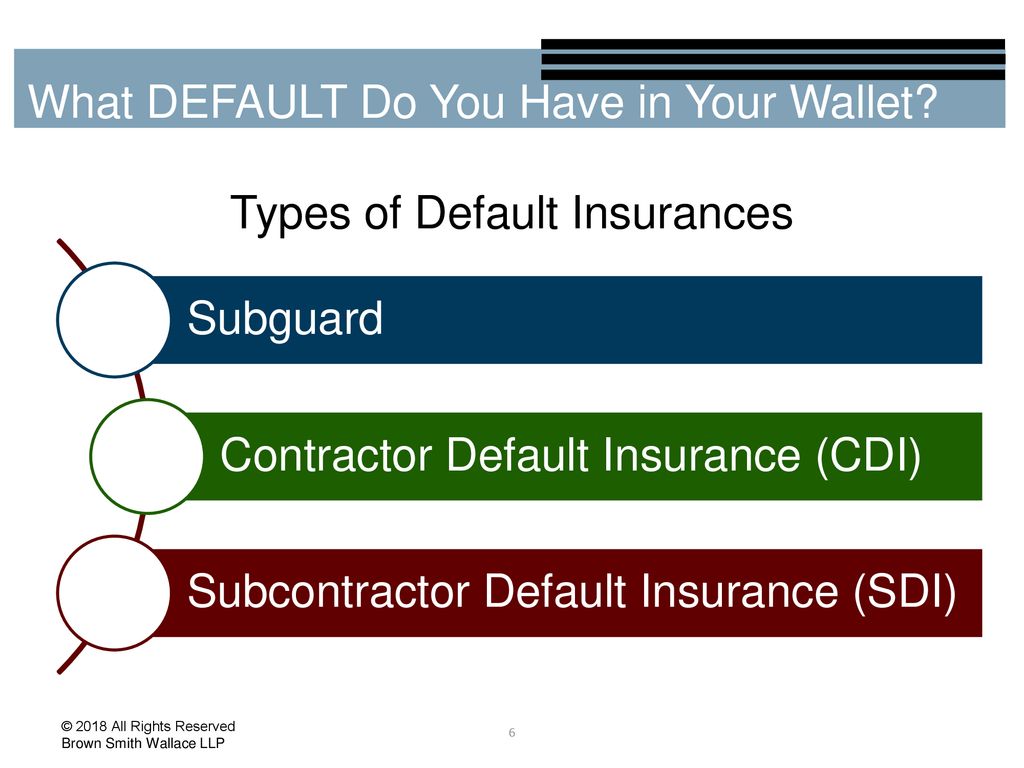

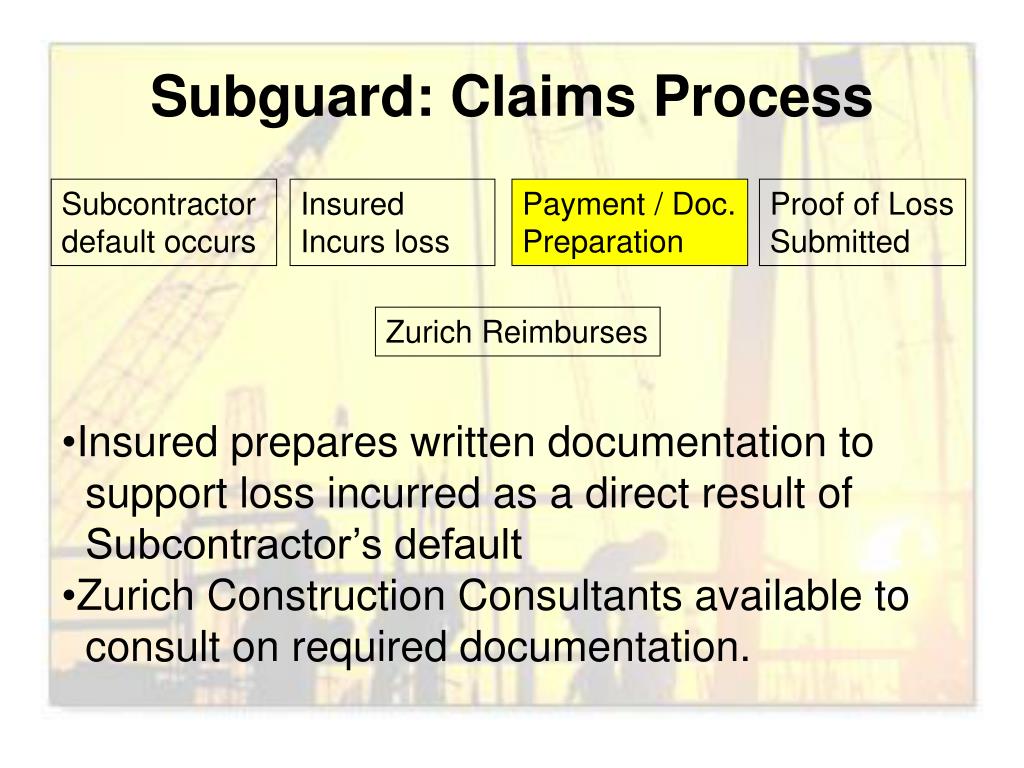

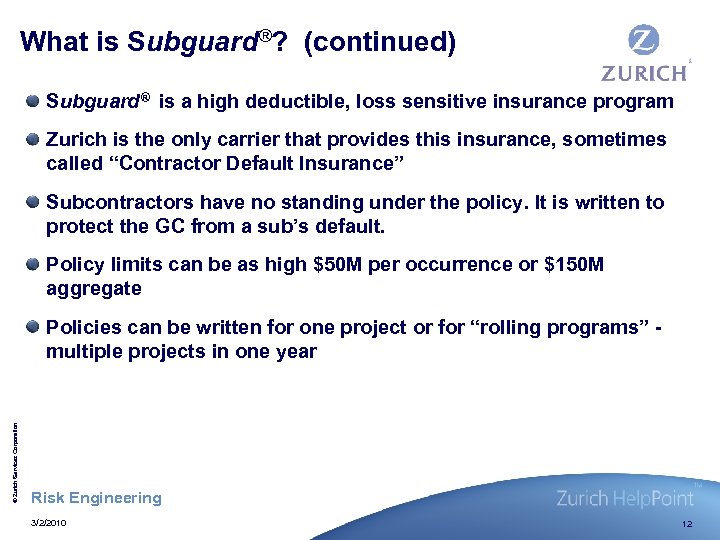

That slowly changed, however, as other insurance companies grew more comfortable with the idea. When people are referring to such insurance, they often call it a “subguard® policy”. Our coverages and services help contractors and design professionals manage risks associated with suppliers and subcontractors, job site hazards, worker safety and quality of work.

The gc is zurich’s client creating just one relationship to manage 3. These products are sometimes referred to as “subguard” insurance based on the name given to one such product offered by zurich north america. Subcontractor default insurance, an alternative to surety bonds, protects the general contractor from losses arising from defaults by unbonded.

Project owner, the gc and zurich 2. Subguard is a comprehensive insurance policy that protects the owner and general contractor against a defaulting subcontractor. Subguard is actually zurich’s offering of sdi.

Zurich helps its customers identify and mitigate subcontractor default risks, including the use of subguard risk management and insurance. For years, zurich insurance ltd. Had been the only insurer that offered sdi, in a line that it called subguard.

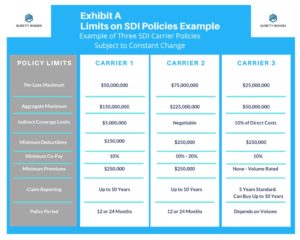

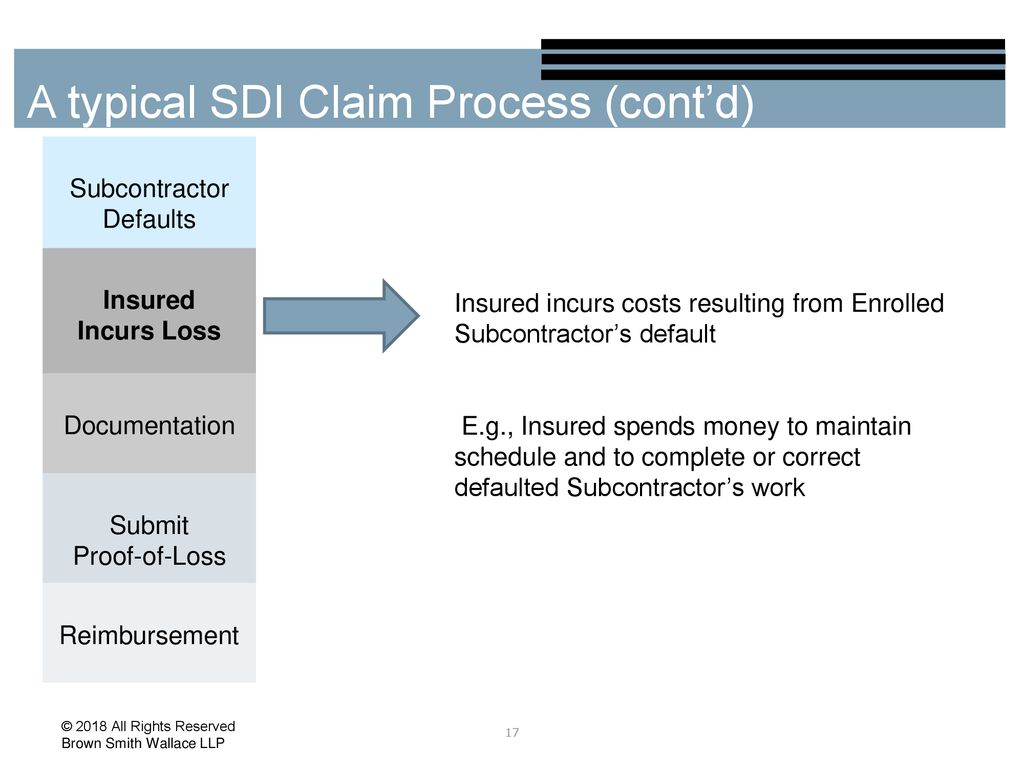

The zurich american insurance company developed the original sdi product (subguard®) in 1996 as a way to respond to subcontractor defaults. Subcontractor default insurance (sdi) provides coverage for economic loss incurred by a general contractor or construction manager caused by a default of performance of their subcontractor (s), including both direct and indirect costs. Subcontractor default insurance (“sdi”) continues to capture market popularity since its invention by the zurich insurance company under the name subguard.

Some people just call it “subguard”. There are three commercial products on the market for subcontractor default insurance, zurich’s “subguard®,” xl insurance’s “constructassure®,” and a product from construction risk underwriters (cru). Since then, at least two other insurance companies, xl catlin and arch insurance, have entered the market to provide di products, including a policy that insures the owner against default risk from the general.

Suretyship has been around for millennia, with references found in ancient greece and the old testament. Subguard® provides first party insurance coverage to general contractors to provide insurance coverage to indemnify general contractor for direct and indirect costs. Subcontractor default insurance is a widely used product by general contractors, but often misunderstood.

Learn more about this insurance coverage here. Rather, the insurer is obligated to reimburse the contractor for. It was introduced in the mid 90s by zurich insurance company.

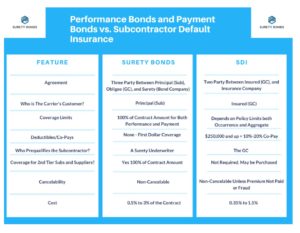

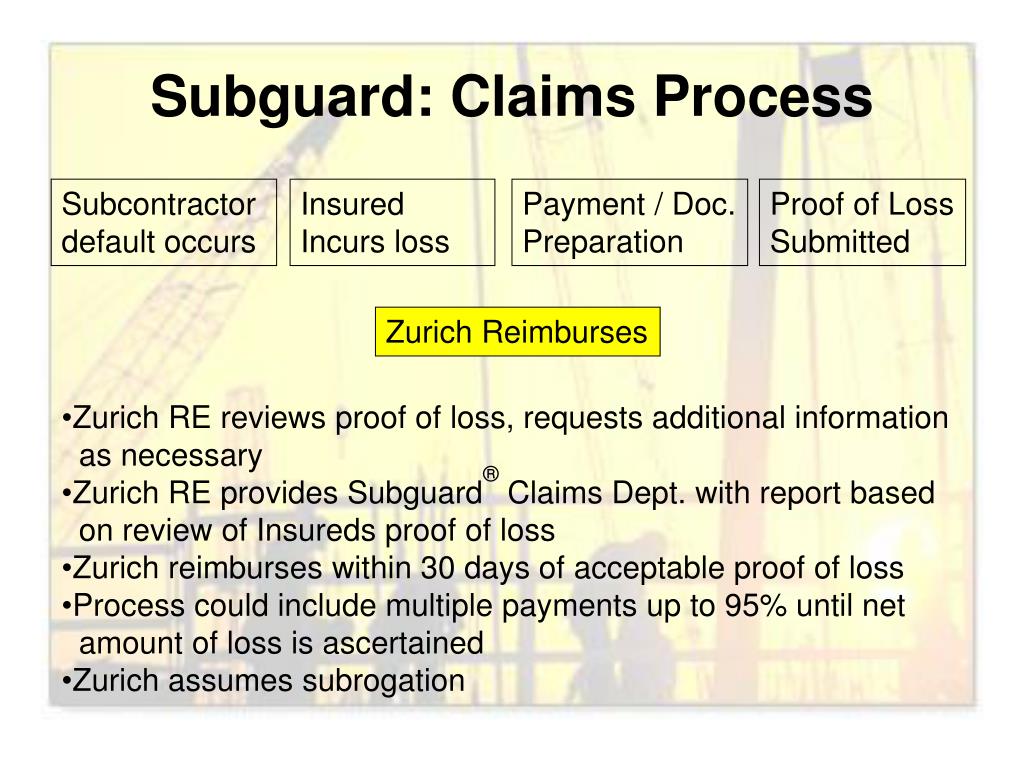

We often get asked about subcontractor default insurance (sdi) and how it compares to surety bonding. The sdi insurer cannot deny coverage for a default by a subcontractor covered by the policy; Zurich north american sells subcontractor default insurance policies under the product name subguard®.

Subguard is zurich’s proprietary product that was first introduced to the market, and that. Contractors take on enormous risk of loss by engaging subcontractors for the performance of work on their projects. Subcontractor default insurance (sdi) i.

Sdi only protects against subcontractor default — not default of the prime contractor — and only the general contractor — not the owner — may assert a claim. There are only a handful of insurers out there that offer sdi, and zurich is the leading carrier. Subcontractor default insurance is commonly referred to as subguard, the policy developed and marketed by zurich surety in 1996 as an alternative to subcontractor performance & payment bonds.

That product insured general contractors against default risk from their subcontractors. Hudson’s subcontractor default insurance (sdi) provides the control and flexibility a general contractor needs to help successfully complete a project on schedule and on budget. A recent new york county, new york, appellate decision highlights the potential inadequacies of subcontractor default insurance (“sdi”).

The zurich insurance group introduced the first di product in 1996.

An Introduction To Subcontractor Default Insurance

Subcontractor Default Insurance Its Use Costs Advantages Disadvantages And Impact On Project Participants - Pdf Free Download

Subguard Benefits And Insights - Pdf Free Download

Understanding Whats Up With Your Subcontractor Default Insurance - Ppt Download

What Is The Big Deal About Subcontractor Default Insurance - Parker Smith Feek Business Insurance Employee Benefits Surety

Subguard Default Insurance Vs Traditional Performance And Payment Bonds For Subcontractors - Pdf Free Download

Performance And Payment Bonds Vs Subcontractor Default Insurance

Subcontractor Default Insurance Thomas Tripodianos Anthony Ca

Subcontractor Default Insurance Thomas Tripodianos Anthony Ca

Understanding Whats Up With Your Subcontractor Default Insurance - Ppt Download

Ppt - Subguard Update Powerpoint Presentation Free Download - Id391782

Subcontractor Default Insurance Thomas Tripodianos Anthony Ca

![]()

Subcontractor Default Insurance Market Set To Expand Business Insurance

Dealing With Risk In A Buyer S Market Richard

Ppt - Subguard Update Powerpoint Presentation Free Download - Id391782

Performance And Payment Bonds Vs Subcontractor Default Insurance

Subcontractor Default Insurance Its Use Costs Advantages - Pdf Document

Subcontractor Default Insurance Its Use Costs Advantages Disadvantages And Impact On Project Participants - Pdf Free Download

Understanding Whats Up With Your Subcontractor Default Insurance - Ppt Download