Extended Term Insurance Policy Meaning

It often covers perils less likely to occur. Policyholders can then choose to extend coverage after a term ends by either 1) purchasing a new policy or 2) converting a qualified term insurance policy to a permanent life insurance policy.

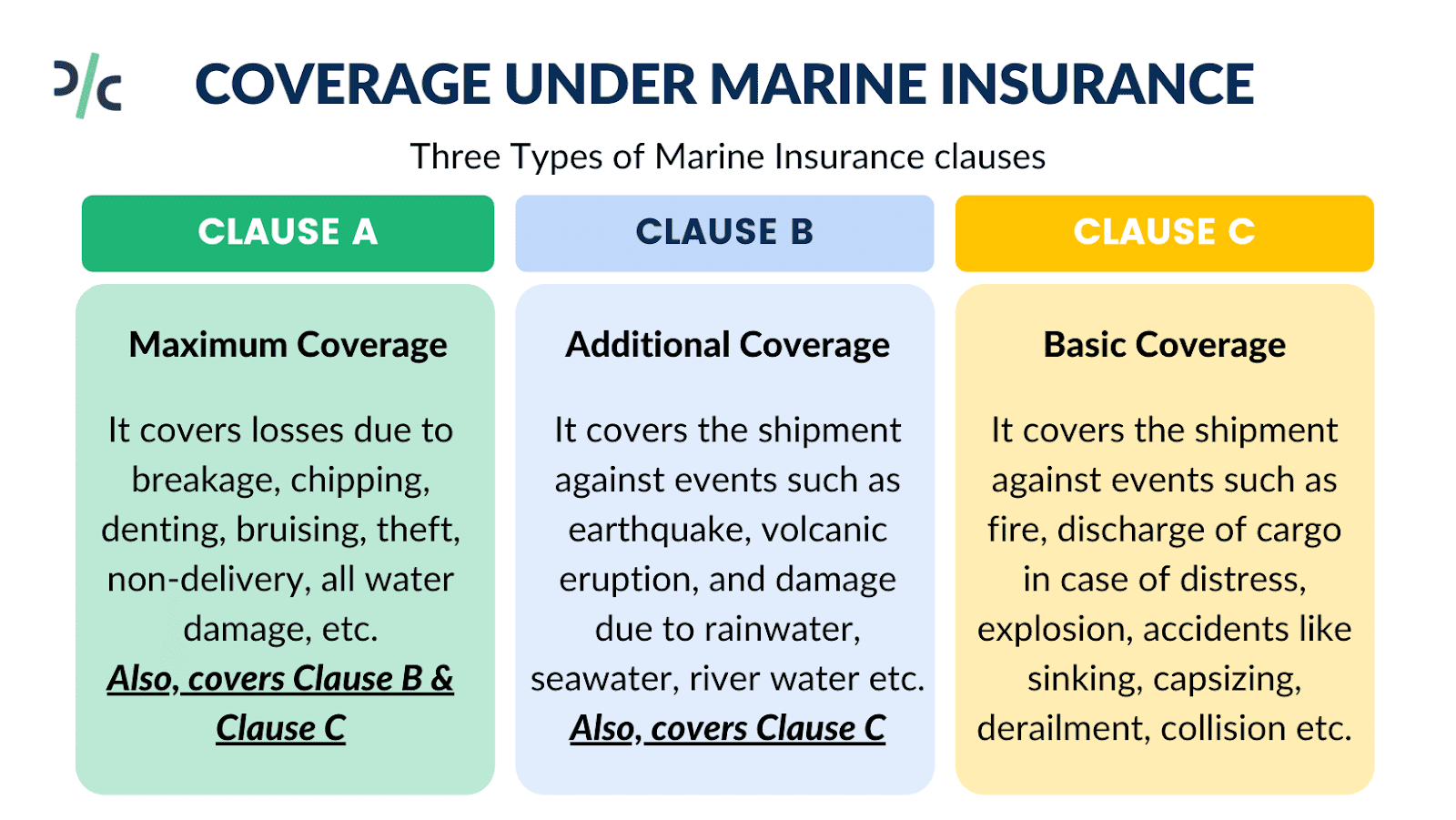

Marine Insurance Meaning Types Benefits Coverage Drip Capital

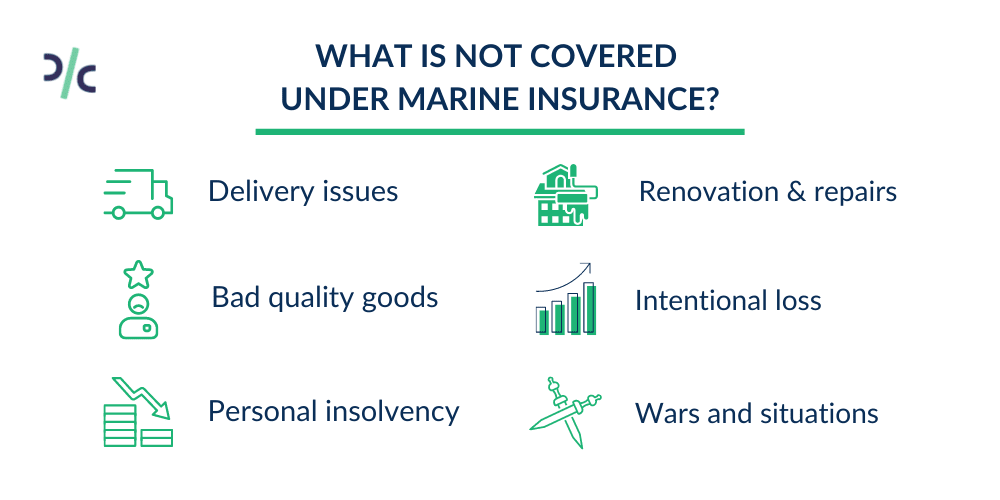

All insurance policies have exclusions for specific causes of loss (also called perils) that are not covered by the insurance company.

Extended term insurance policy meaning. Extended replacement cost insurance adds money to what you can draw from to rebuild, allowing you to afford these increased costs if such an event occurs. For instance, a waiver of premium rider will allow you to continue your term life coverage for a limited time if you are unable to pay the premium. A level term policy pays the same benefit amount if death occurs at any point during the term.

Life insurance that after cessation of premium payments is continued in its original amount. Extended term insurance is a type of life insurance that is designed to make whole life insurance more attractive. Once that period ends, so does the coverage.

Term insurance policies are only designed to last a certain length of time, called a term. Or extended term insurance definition of extended insurance : When you purchase a whole life insurance policy, part of the premiums that you pay are going to go towards accumulating a cash balance.

This is something that has to be in place when you buy the policy though, not something that can be just added on because you see your term is running out and would that option. Depending on the percentage you chose, your new coverage amount could be anywhere from $275,000 to $375,000. Here are the basics of extended term life insurance and how it works.

Extended term insurance is a nonforfeiture option on a whole life policy that uses the policy's cash value to buy term insurance for the current whole life death benefit for a specified period of time. Buying a whole life insurance policy for a relatively low amount and supplementing the coverage with a larger term rider will allow you to lock in lower premiums while you’re younger. Amanda shih is an insurance editor and licensed life, health, and disability.

Ad affordable, flexible term life insurance at your pace. Nupur gambhir is an insurance editor at policygenius and licensed life, health, and disability agent in new york. You have a $100,000 whole life policy that has built up some cash value.

Meanwhile, if you decide you need still more coverage in 10 or 15 years, you may be able to increase the amount of your term rider to make up the difference. Here is an example : Term insurance rider is an attachment or amendment to an insurance policy that supplements the coverage in the policy.

The terms “level” and “decreasing” refer to the death benefit amount during the term of the policy. Till you are 58 or 60 years old. Term insurance policy is not recommended for a period that covers you beyond age 60 (65 in some cases) under any condition.

Extended coverage is insurance coverage that goes beyond what a standard policy offers. Extended coverage is a term used in the property insurance business. Term insurance comes in two basic varieties—level term and decreasing term.

Ad affordable, flexible term life insurance at your pace. Extended term life insurance is coverage that is provided by the cash value in a life insurance policy. The feature primarily seeks to help those who find themselves in a situation where the whole life premium is no longer affordable.

The policy is usually a whole life policy, but can originate from other cash value plans. Life insurance policies dictate how much of a payout people will receive following the death of a loved one. These days, almost everyone buys level term insurance.

An extended coverage endorsement (ec) was a common extension of property insurance beyond coverage for fire and lightning. If the investment portion of the insurance policy is sufficient to cover payments for it, the holder of an extended term insurance can simply modify their whole life insurance policy into a term life policy paid for through the whole life policy's cash accumulation. Term life insurance, also known as pure life insurance, is a type of life insurance that guarantees payment of a stated death benefit if the covered person dies during a specified term.

When you outlive your term policy, you will no longer have life insurance coverage—but you can convert to a permanent policy or buy new term insurance. Those extra benefits/ privileges that can strengthen a term plan by shedding few extra bucks are called term insurance riders. Typically, it is purchased separately from a standard policy and functions as an extension of the primary coverage.

Extended term insurance definition, life insurance in which a policyholder ceases to pay the premiums but keeps the full amount of the policy in force for whatever term the cash value permits. Technically speaking, this is your only option to actually “extend” your term life insurance policy. We have listed these below.

Extended term insurance — a nonforfeiture provision in a whole life policy that uses cash value to purchase term insurance equal to the existing amount of life insurance.

How To Calculate The Sum Assured And Premium Of Life Insurance - Abc Of Money

How Hybrid Life Insurance Pays For Long-term Care Forbes Advisor

/State_Farm_recirc_image-43af5e80de594cadab4e2a5adf8bb4e9.jpg)

State Farm Life Insurance Review

Guide To Whole Life Insurance For 2021 Forbes Advisor

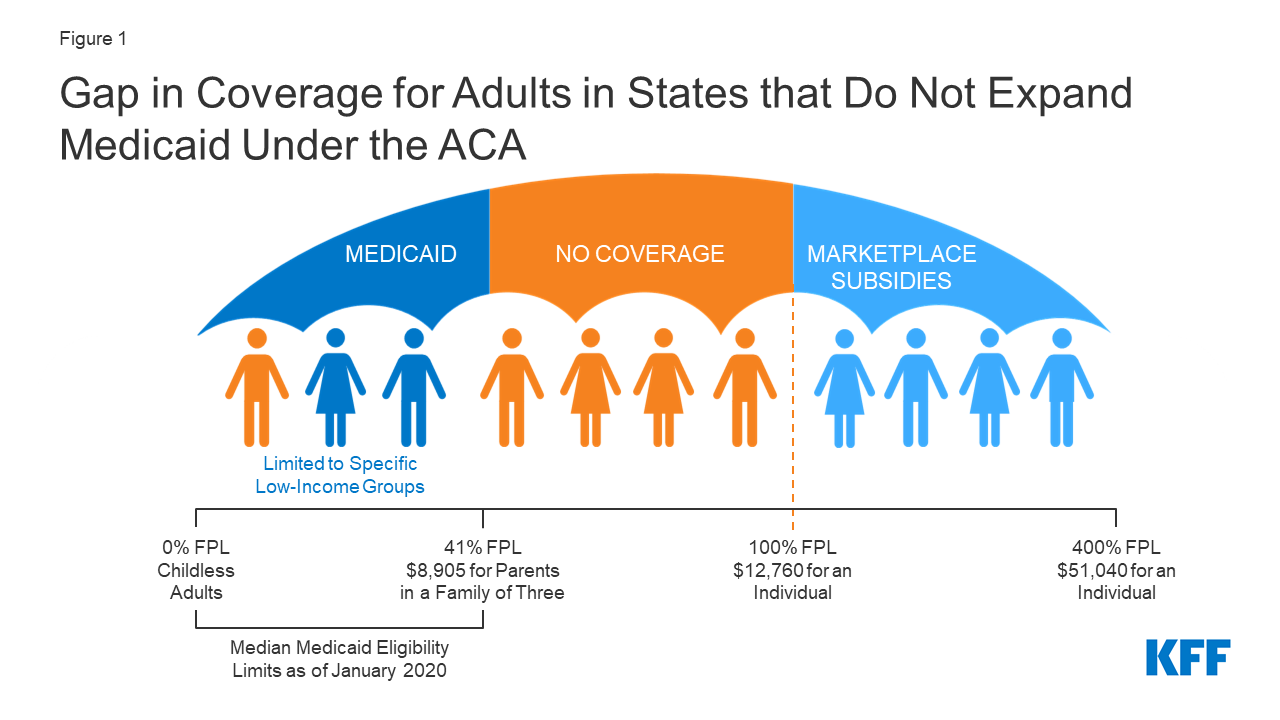

The Coverage Gap Uninsured Poor Adults In States That Do Not Expand Medicaid Kff

What Is Insurance Definition Types Benefits Max Life Insurance

Term Plan With Return Of Premium - Trop 2021 Policybazaar

What Is Insurance What Are The Types Of Insurance Paytm Blog

Marine Insurance Meaning Types Benefits Coverage Drip Capital

How Does Whole Life Insurance Work Costs Types Faqs

What Is Insurance Definition Types Benefits Max Life Insurance

/life-insurance-56a8fd255f9b58b7d0f70ba2.jpg)

Adjustable Life Insurance Definition

Insurance Types Life And General Insurance - Explained Guide

Is Life Insurance Worth It

Term Plan With Return Of Premium - Trop 2021 Policybazaar

What Is Insurance Definition Types Benefits Max Life Insurance

Guide To Whole Life Insurance For 2021 Forbes Advisor

/Education_and_Advice/CNBU_Articles/Life-Insurance.png)

Why Did The Premium On My Term Life Insurance Go Up - Canandaigua National Bank Trust

Gerber Grow-up Plan And Life Insurance Review - Valuepenguin